Best Group Insurance in Ontario

Get an affordable group health insurance quote within minutes

Comprehensive group health insurance in Ontario

Canada has 1.3 million businesses, with nearly 480,000 of them in Ontario, making group benefits a crucial investment for employers in the province. Offering group insurance in Ontario helps businesses attract top talent, improve retention, and support employee well-being with health, dental, and life insurance coverage.

Why offer group benefits in Ontario?

Businesses that offer group benefits in Ontario can strategically attract and retain top talent. For a small business, group benefits help improve employee morale, increase productivity, and provide financial protection against health-related expenses.

Notably, 85.4% of Canadian employees consider employee benefits and salaries the most important job attributes! Therefore, in a province with a competitive job market, rising living costs, and a rapidly evolving economy, a strong benefits package can set your business apart and create a more stable, committed workforce.

Small business group benefits in Ontario

A well-structured group benefits plan helps small businesses attract and retain top talent while keeping employees engaged and valued. At PolicyAdvisor, our licensed experts simplify the process by comparing and customizing coverage from 30+ leading Canadian providers.

With plans starting at just $80 per month, small businesses can access affordable, high-quality benefits customized based on their needs.

How to set up employee benefits in Ontario?

Setting up a small business benefits plan is a simple process that includes the following steps:

- Sign-up & setup: Complete and sign documents with your advisor; setup takes up to two weeks

- Employee enrollment: Employees receive an activation email to enroll

- Billing: The first billing statement is issued after employee enrollment

- Plan activation: Employees can start using their benefits

- Administrator access: Credentials provided for the admin portal, with insurer guidance

I need insurance. Where do I start?

Our calculator gets you the right quotes and the lowest rates.

Average cost of benefits per employee in Ontario

The average cost of an employee benefits package depends on employee demographics, claims history, and plan details. Typical costs vary between:

- $80-$200/month/employee for a basic plan

- $100-$250/month/employee for a more enhanced plan

- $150-$350/month/employee for comprehensive coverage

| Factor | Impact on cost |

|---|---|

| Business size | Larger groups benefit from lower per-employee costs |

| Plan type | Basic plans are more affordable; comprehensive plans cost more |

| Employer contribution | Employers typically cover 50% to 100% of premiums |

| Employer demographics | Older or higher-risk employees may increase premium costs |

| Industry risk level | High-risk industries (e.g., construction) often face higher group benefit rates |

Are group benefits taxable in Ontario?

In Ontario, employer-paid premiums for group life and health benefits are subject to an 8% Retail Sales Tax (RST). Additionally, a 2% Provincial Premium Tax (PPT) applies to these premiums.

While employer contributions to health and dental plans are generally non-taxable benefits for employees, contributions to group life insurance are considered taxable benefits and must be reported as income. Let’s take a look at a sample plan for a small business with 20 employees.

| Coverage/Plan | Basic | Standard | Enhanced |

|---|---|---|---|

| Health (Single) | $50/month | $70/month | $92/month |

| Health (Family) | $110/month | $170/month | $195/month |

| Dental (Single) | $30/month | $60/month | $81/month |

| Dental (Family) | $170/month | $200/month | $250/month |

| Life Insurance & AD&D ($25,000/$50,000/$75,000) | $12/month | $18/month | $26/month |

| Total (20 employees) | $3,000/month | $4,100/month | $5,500/month |

| Cost per employee | $150/month | $205/month | $275/month |

Customizable group benefits for Ontario businesses

Ontario’s diverse economy, driven by manufacturing, automotive, technology, real estate, finance, and insurance, requires flexible benefits plans that meet the unique needs of businesses in different sectors.

Group health insurance companies in Ontario offer employers the flexibility to customize coverage based on their industry and workforce, with options like Health Spending Accounts (HSAs).

How to get a free group quote?

Looking for a free Ontario employee benefits quote? Reach out to our team of licensed group insurance advisors at any time. We’re happy to help walk you through it or find the best deals for you!

Looking for affordable employee benefits?

Call us at 1-800-601-9980 to speak with our licensed advisors right away, or schedule a time with them below.

Who is eligible for small business employee benefits in Ontario?

Small businesses of all sizes can access group benefits, even those with just one employee. Group benefits for small business Ontario plans are designed to be flexible and affordable so that every employer can meet their team’s unique needs.

To qualify for small business group benefits in Ontario, businesses typically need:

- At least one full-time employee (owners can often be included)

- A stable source of revenue to maintain contributions

- Employer contribution to premiums (usually 50% or more)

Benefits of group health insurance for small businesses in Ontario

A Canada Benefits survey reveals that 79% of employees prefer benefits over a pay raise! So, as a small business, offering group benefits helps:

- Attract and retain talent

- Save costs due to risk pooling

- Improve employee retention

- Provide financial security

- Save on tax-deductible premiums

- Boost productivity, morale, and overall wellness

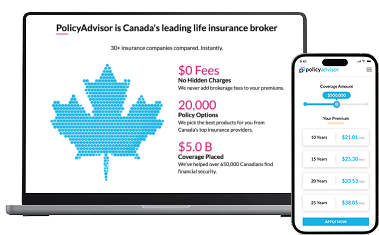

Why PolicyAdvisor?

PolicyAdvisor makes finding group health insurance simple. Compare quotes, get expert advice, and find the best policy for your needs-all in one place.

- Save time: Get instant quotes from Ontario’s top group insurance companies

- Save money: Compare multiple quotes to find the best price

- Shop anywhere: Use our online tools to compare quotes from your phone or computer

- Personalized service: Receive expert advice from a dedicated group insurance advisor

Get affordable group insurance, online, and in minutes!

Frequently asked questions