Life Insurance For 30-Year-Olds

Save 40% Or More On Insurance In Your Thirties

Get Instant Quotes from the Top 25 companies in Canada

Trusted by Canadians

Excellent Service

Thank you for the excellent customer service. You’ve been very supportive in all our questions. We appreciate your time, effort, and support in giving us updates and replying to our late night emails, follow-ups and phone calls. Thank you team!

Jessa

Simple process

Our advisor helped answer all our questions in a timely manner, and the process was much more simple. I really like that they did the comparisons of policies for us. It can be overwhelming for people that do not have experience with insurance policies.

Joanne V

Best rate

If you’re looking for best rate and an advisor, I would highly recommend. They are expert in finding the best insurance provider. Reliable and give unbiased advise. I’m glad I came across Policy Advisor online as they were able to help get my insurance approved.

Zeny D

Made my day

PolicyAdvisor.com made my day when I encountered with the website. When I did the quote, I was happy by the amount I will be saving once the application goes through. My advisor was informative, patient and kept me up to date. I am one happy client!

Samantha D

What is the average life insurance cost for a 30 year old?

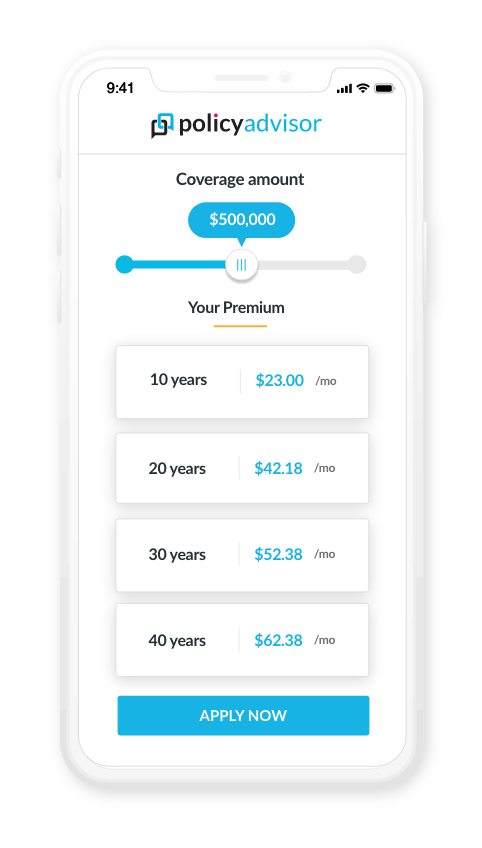

Term life insurance rates can be as low as the cost of an extra-large pizza.

The cost of life insurance for a 30 year old depends on several individual factors, there’s no catch-all figure that would give you an accurate estimate. However, for most young, healthy adults the cost of term insurance is reasonable on a 20-year term policy. Eighty percent of millennials overestimate life insurance costs by up to five times the actual price. Luckily, you can get instant term life insurance quotes for rates like those presented here whenever you have 60 seconds to use our tools on your phone or computer.

| AGE | MALE | FEMALE |

|---|---|---|

| 30 | $31 | $23 |

| 32 | $32 | $24 |

| 35 | $33 | $26 |

| 37 | $39 | $30 |

| 39 | $45 | $34 |

Representative values for the average life insurance cost per month in your thirties, $500,000 death benefit, non-smoking, 20-year term.

Why should you get life insurance your thirties?

Because of your youth and health at 30, you can lock into lower insurance rates without health afflictions affecting them. Additionally, there is less likely a chance of your relatives being diagnosed with a health condition that may affect your insurance rates.

Term life insurance gives you the most flexibility in your thirties. You may need to cover debts and obligations like a mortgage, a partner, children, or a parent should you pass away. Most plans have the flexibility to convert term coverage into permanent life plans down the line if you find yourself needing longer coverage as your life changes.

Why PolicyAdvisor?

PolicyAdvisor is a digital-first insurance broker, using technology to make life insurance simpler, smarter and more rewarding.

| Policyadvisor .com | Insurance Brokers | Insurance Agents | |

|---|---|---|---|

| Simple, quick, online |  |

|

|

| Compare 25+ companies |  |

|

|

| Live advisor support |  |

|

|

| Impartial, trusted advice |  |

|

|

| Commission-free advisors |  |

|

|

| Apply from anywhere |  |

|

|

PolicyAdvisor is one of Canada’s top insurance brokers. Reviews from all over the web confirm our commitment to making insurance accessible to all Canadians and to provide you with the absolute best customer experience while comparing and applying for your insurance policy.

How PolicyAdvisor Works?

At PolicyAdvisor we’ve made the process of buying life insurance as easy and painless as possible. In fact, in just a few short minutes you could be on the way to obtaining coverage, protecting your loved ones, and having the peace of mind knowing you’ve taken care of all your protection needs.

1

STEP 1

Get quotes quickly

Get the best quotes across insurance companies

2

STEP 2

Zero in on best option

Our advisors guide you to the best product and company for your unique situations

3

STEP 3

Submit application

Once finalised, we help submit your application. Yes, we will scout to multiple companies if there are complications

Need insurance answers now?

Call 1-888-601-9980 to speak to our licensed advisors right away, or book some time with them below.

Insurance of a life insurance policy is subject to product availability and your eligibility. Any policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the respective insurance company following the completion of the underwriting on the application.

1-888-601-9980

1-888-601-9980