As one of the almost 2.5 million Canadians with diabetes (source: Statistics Canada), you may have hit some stumbling blocks or even brick walls on your search for insurance of any kind. Getting life insurance when you are diabetic can be a little less straightforward than for those without it. But, it is possible to obtain life insurance for diabetics, and it may be less expensive than you assumed.

Why does diabetes affect insurance rates?

Diabetes is a disease that affects how your body uses and produces insulin, a hormone produced by your pancreas. There are three types of diabetes: Type-1 diabetes, Type-2 diabetes, gestational diabetes.

Type-1 diabetes

It is also known as insulin-dependent diabetes, is an auto-immune disorder. For Type-1 diabetics, their pancreas no longer produce insulin, a hormone that helps your body convert sugar to the energy you need. You need to administer synthetic insulin to cover for the food you eat

Type-2 diabetes

People with type 2 diabetes produce insulin, but their bodies do not use or recognize it correctly. They can deal with the condition through oral medication or diet. Type-2 diabetes is the most common form of diabetes in Canada, with approximately 90% of diabetics living with Type-2 diabetes.

Gestational diabetes

It is a temporary form of diabetes associated with pregnancy. The body cannot produce an adequate amount of insulin, leading to an increase in the amount of blood sugar. In most cases, gestational diabetes goes away post-pregnancy

So why would diabetes affect life insurance policy premiums? Well, the stress of constantly fluctuating blood sugar levels puts stress on your internal organs, like your heart and kidneys. The added stress means your organs are prone to failure in their older years. Thus, approving your application takes on added risk factors and adds to the cost of life insurance.

More specifically, Type-1 insulin-dependent diabetes is usually diagnosed in childhood and puts a lifetime of stress on one’s body. This is why insurance rates for Type-1 diabetics are higher.

Type 2 diabetes is more prevalent in individuals after the age of 40, and its effects can be quickly remedied by diet; organ stress is not as great of a factor in medical underwriting.

Gestational diabetes does not usually affect insurance rates, as most expecting mothers opt to do any medical underwriting before or after their pregnancy.

Can diabetics get life insurance?

Yes, diabetics in Canada can get life insurance in Canada. Diabetics who are in good health, with consistent medication levels, and who keep their blood sugar levels in control can qualify for standard, medically underwritten life insurance coverage.

In medically underwritten life insurance, the life insurance company will arrange for a blood test and likely request for a physician’s report to evaluate and screen for a pre-existing condition and grant approval for a life insurance policy. This process may provide more a higher death benefit for a lower premium, than no medical life insurance.

Much like anyone with a pre-existing health condition, no medical life insurance is another choice for diabetics. No medical life insurance is a policy that is issued without the insured having to undergo a medical exam. It usually has the added advantage of a simpler and faster issuance process that doesn’t require details for every medical condition one may have.

The two most common types of no medical life insurance are simplified issue and guaranteed issue. Read more about simplified vs guaranteed.

What are the types of life insurance available to diabetics?

In Canada, diabetics have several life insurance options, though the specifics can vary based on individual health conditions and insurance providers. Here are the primary types of life insurance policies accessible to diabetics:

Term life insurance

Term life provides coverage for a specific period (e.g., 10, 20, 30 years) and is generally more affordable than permanent life insurance.

Term life insurance may have higher premiums for diabetics depending on how well the condition is managed and overall health factors

Permanent life insurance

A permanent life insurance policy includes whole life and universal life insurance. It offers lifetime coverage with an added savings or investment component and has higher premiums than term life insurance. This may also require more stringent medical exams for diabetics

Simplified issue life insurance

Simplified issue life insurance requires no medical exam but only a health questionnaire, designed for individuals with health issues who might have difficulty qualifying for traditional life insurance. This policy typically has higher premiums and lower coverage amounts and is often easier for diabetics with well-managed conditions to obtain

Guaranteed issue life insurance

A guaranteed issue policy involves no medical exams or health questions and guarantees acceptance up to a certain age (e.g., 75 years). It has higher premiums and lower coverage amounts and often includes a waiting period (e.g., 2 years) before the full death benefit is paid out.

This is suitable for diabetics with significant health issues or those who have been declined other types of insurance

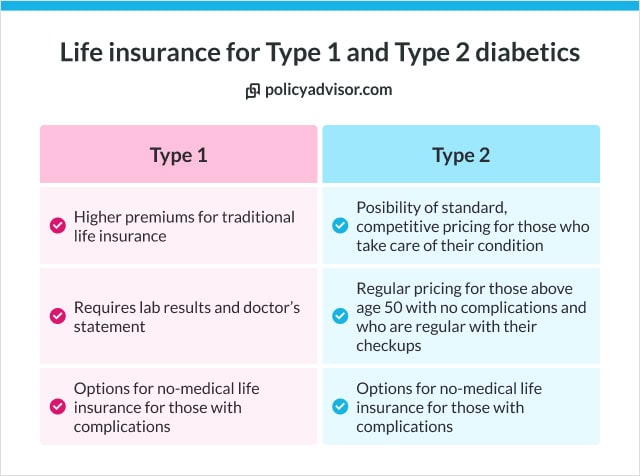

Comparing life insurance options for Type 1 and Type 2 diabetes patients

Securing life insurance as a diabetic can be challenging, but options exist for both Type 1 and Type 2 diabetes. The eligibility, cost, and coverage depend on factors like age, disease duration, treatment stability, and overall health.

While traditional life insurance requires medical exams and detailed health records, no-medical life insurance offers a quicker, hassle-free alternative, but at a higher premium. Understanding the differences in insurance options for Type 1 and Type 2 diabetes can help individuals find the best coverage for their needs.

Best life insurance for type 1 diabetics

The availability of a life insurance policy for people with type 1 diabetes depends on the age of the applicant, duration of the disease, and degree of control. Traditional life insurance companies that require lab results will also seek a doctor’s statement to establish the stability of the treatment and the condition.

In most cases, a life insurance company may apply a rating (higher premium) when approving life insurance for those with type 1 diabetes. No-medical, questionnaire-based options make for an easier and faster process in such cases, albeit they offer life insurance for diabetics at higher premiums.

For no-medical questionnaires, the focus is primarily on the age of the insured, the stability of the medication, and the risk of complications. If you are older, with no change in your insulin dependence in the last 12 months and no associated complications, you can easily get life insurance with no medical exam or obligation to provide medical records.

Best life insurance for type 2 diabetics

People with type 2 diabetes can get life insurance in Canada with the possibility of standard, competitive pricing. Life insurance companies are usually more accommodating when offering life insurance to people with diabetes who do not require insulin injections.

Traditional insurance companies may even consider granting standard regular-health pricing (even more affordable life insurance) to someone who is:

- Above the age of 50

- Controlling their blood glucose levels and providing lab results with A1C levels

- Undergoes regular medical check-ups with a physician or specialist

- Is treated with oral medications that have not been increased in the past 12 months

- Follows a diet

- And has no diabetes diagnosis associated complications

There are also several options with no medical exam for people with diabetes who may not be able to get standard pricing or those that may want easier and faster access to life insurance.

Most no-medical life insurance questionnaires contain a few questions that seek to assess how long you have had type 2 diabetes, whether your medications have changed recently, and whether you have any complications associated with this type of diabetes. Based on simple binary questionnaires, the eligibility of life insurance for diabetics can be established fairly quickly.

Best life insurance companies for diabetics in Canada

There are several companies in Canada that cater to individuals looking for life insurance in Canada. Here are some of the best ones to look out for:

- Canada Life

- Sun Life Assurance Company of Canada

- Manulife

- Desjardins Financial Services

- Industrial Alliance Life Insurance

- Beneva Inc.

- Royal Bank of Canada (RBC)

What factors affect insurance rates for diabetes?

Several factors affect insurance rates for diabetics, as insurers evaluate risk based on how well the condition is managed and its impact on overall health. Here’s a collated list of factors that influence insurance rates:

Age

- Your age when you apply for a policy: Younger applicants generally secure better rates due to lower perceived risk

- Your age when you were diagnosed with diabetes: Earlier diagnosis can lead to higher rates due to longer potential exposure to complications

Type of diabetes

- Type 2 diabetes: More common and generally considered less risky compared to Type 1 diabetes but still affects rates

- Type 1 diabetes: Often associated with higher risk due to its complexity and potential for complications

- Gestational diabetes: Typically resolves after pregnancy; however, if it leads to Type 2 diabetes later, it can affect rates

Severity of your diabetes or blood sugar control

- Well-controlled diabetes with stable blood sugar levels is viewed more favorably by insurers

- Poor control with fluctuating blood sugar levels or complications can increase risk and lead to higher premiums

Other medical conditions

- Additional health issues can increase risk and affect premiums

- A family history of diabetes or related health conditions can influence rates

- Excessive alcohol consumption can impact overall health and increase insurance premiums

Tips to lower life insurance rates for diabetics

Lowering life insurance rates for diabetics will require you to take proactive steps to manage your condition effectively and demonstrate overall good health to insurers. Here are some tips to help reduce premiums:

- Maintain good control of blood sugar levels through regular monitoring and adherence to treatment plans, which shows effective management of diabetes to insurers

- Adopt a healthy lifestyle with a balanced diet and regular exercise, which can help improve overall health and potentially reduce the risk of diabetes-related complications

- Avoid smoking and limit alcohol consumption, as these factors can negatively impact health and lead to higher insurance premiums

- Regularly visit healthcare providers for check-ups and management of diabetes, showing insurers that the condition is being actively monitored and managed

- Keep detailed records of your diabetes management, including medications, lifestyle changes, and doctor visits, to provide evidence of effective control to insurers

- Compare quotes from multiple insurance providers, as different companies may have varying criteria and rates for diabetics

- Work with an insurance expert who specializes in high-risk cases so you can find a policy that suits your specific health conditions

How to get life insurance with diabetes?

Getting life insurance with diabetes can be more challenging, but with the right approach, you can find suitable coverage. Here’s a step-by-step guide to help you:

Gather your medical information

- Collect recent medical records, including blood sugar levels, HbA1c test results, and any other relevant health information

- Prepare a list of all medications you are taking

- Note any lifestyle changes you’ve made, such as diet and exercise routines

Manage your diabetes effectively

- Regularly monitor and maintain your blood sugar levels within the target range

- Follow a balanced diet, exercise regularly, avoid smoking, and limit alcohol consumption

- Visit your healthcare provider regularly for diabetes management and check-ups

Provide accurate information

- Submit accurate and detailed records of your diabetes management, including medications, lifestyle changes, and doctor visits, to show that you are managing your condition well

Apply for insurance

- Complete the application process, which may include a medical exam for some types of insurance

- If a medical exam is required, prepare by fasting if instructed, getting a good night’s sleep, and avoiding strenuous activities beforehand

Review and choose the best policy

- Policy review: Carefully review the terms, conditions, and exclusions of your policy

- Cost vs. coverage: Balance the cost of premiums with the coverage provided to ensure it meets your needs and budget

- Final decision: Choose the policy that offers the best balance of coverage and affordability

Why does timing matter with life insurance for diabetics?

Timing matters when applying for life insurance as a diabetic because your current health status and diabetes management can significantly influence the premiums and coverage options you receive. Here are some reasons why timing is crucial:

- Stable condition: Applying when your diabetes is well-controlled and stable can result in more favorable premiums.

- Recent health improvements: If you’ve recently made positive changes to your lifestyle, such as losing weight, quitting smoking, or improving your diet and exercise habits, waiting until these changes are reflected in your medical records can lead to better rates

- Medical advancements: If new treatments or medications for diabetes have been effective for you, showing a period of stability and improved health can work in your favor with insurers

- Age considerations: Life insurance generally becomes more expensive as you age, so, applying when you are younger and your diabetes is under control can help lock in lower rates.

- Health monitoring: Regular check-ups and maintaining detailed health records over time can demonstrate a consistent pattern of good diabetes management, which can be appealing to insurers

- Temporary health issues: If you have temporary health issues unrelated to diabetes, waiting until you recover from these conditions can help you avoid higher premiums that might result from a recent illness or medical event

- Gestational diabetes resolution: If you developed gestational diabetes during pregnancy and it has since resolved, waiting until you have a track record of normal blood sugar levels and stable health can improve your chances of obtaining better life insurance rates

Life insurance and diabetes: What can help or hurt your case

When applying for life insurance with diabetes, several factors can influence your application positively or negatively. Understanding these factors can help you navigate the process and potentially improve your chances of securing favorable rates.

| Factors That Can Help | Factors That Can Hurt |

| Stable blood sugar control: Demonstrating consistent management through stable levels can lead to more favorable premiums | Poor blood sugar control: Inconsistent or poorly managed diabetes with fluctuating levels can lead to higher premiums |

| Healthy lifestyle: A balanced diet, regular exercise, and avoiding smoking and excessive alcohol consumption can improve overall health and lower premiums | Unhealthy lifestyle choices: Smoking, excessive alcohol use, and poor diet can increase insurance costs |

| Recent improvements: Showing positive changes in diabetes management or overall health can be beneficial | History of recent medical issues: Recent health problems unrelated to diabetes can negatively influence premiums |

| Regular medical check-ups: Maintaining regular visits with healthcare providers and detailed health records can help prove effective management | Presence of complications: Diabetes-related complications, such as neuropathy or retinopathy, can increase perceived risk and affect rates |

| Age considerations: Applying for insurance while younger and with well-controlled diabetes can result in lower rates | Additional health conditions: Other health issues or comorbidities can further increase risk and premiums |

What are some questions insurers may ask about your diabetes?

When applying for a policy that requires a health questionnaire or physical exam, insurers will ask about your general health, lifestyle, and family medical history. They will also have specific questions regarding your diabetes, such as:

- What type of diabetes do you have? Understanding whether you have Type 1, Type 2, or gestational diabetes helps insurers assess risk levels

- When were you diagnosed? The age of diagnosis can impact perceived risk, with earlier diagnoses potentially affecting rates

- Do you monitor your glucose levels regularly? Regular monitoring indicates effective management of your condition

- Are you taking insulin, oral medication, or both? If so, provide details on the number of insulin units per day, types of medications, and dosages

- What is your current diet and exercise routine? Your lifestyle choices can affect your overall health and diabetes management

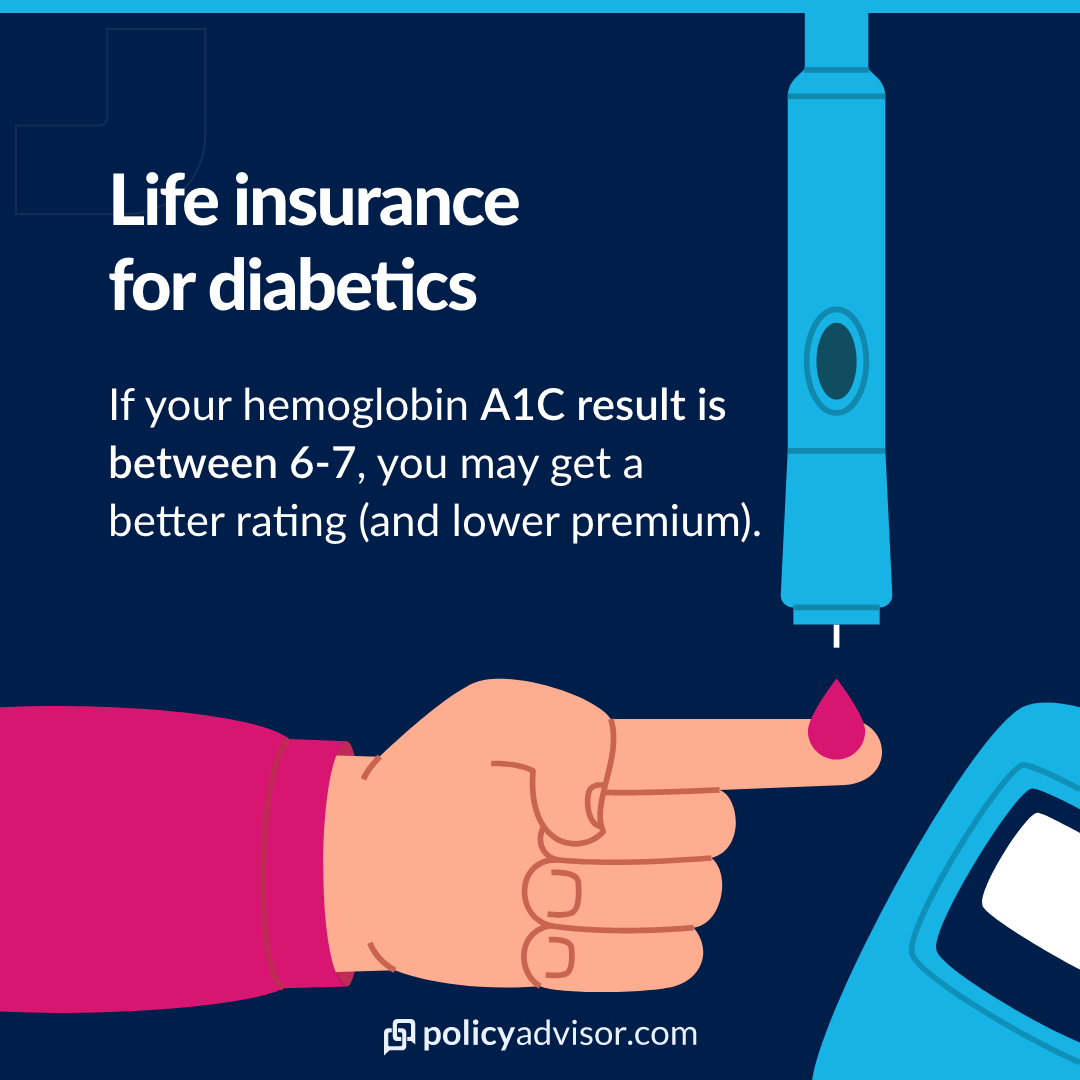

- What is your current A1C level? This provides insight into your long-term blood sugar control

- What has been your average A1C reading over the past year? Consistency in A1C levels is important for assessing diabetes control

- Have you had any other tests related to your diabetes? This includes tests for complications or related conditions

- Who is your primary care doctor and when was your last visit? You may need to provide contact details for your healthcare team, including endocrinologists

- Do you have any diabetes-related complications? This could include high blood pressure, vision impairment, blackout spells, or kidney issues

- Have you been diagnosed with any other serious medical conditions? Conditions like coronary artery disease or kidney disease can affect insurance rates

- Have you ever experienced a diabetic or insulin coma? Such events may impact your risk profile and premiums

- Are you currently on dialysis? Dialysis indicates severe complications and can significantly affect insurance costs

- Have you had any recent hospitalizations or emergency room visits related to your diabetes? Recent health events can influence risk assessment

- Have you made any recent changes to your diabetes medication or treatment plan? Recent changes can affect your current health status and risk profile

- What is your current weight, and have you experienced any significant changes recently? Weight fluctuations can impact diabetes management and overall health

- Have you been advised by your doctor to make any lifestyle changes or undergo additional treatments? Shows ongoing medical advice and treatment adjustments

Frequently asked questions

What is the best type of life insurance for diabetics in Canada?

The best type of life insurance for diabetics often depends on individual health conditions and needs. Generally, term life insurance may be more affordable, while permanent life insurance offers lifetime coverage and an investment component. Simplified issue and guaranteed issue life insurance policies might also be options for those who prefer not to undergo a medical exam.

Can diabetics get approved for life insurance in Canada?

Yes, diabetics can get approved for life insurance in Canada. Approval and rates depend on factors such as the type of diabetes, control of blood sugar levels, and overall health. Insurance companies assess these factors to determine eligibility and premiums.

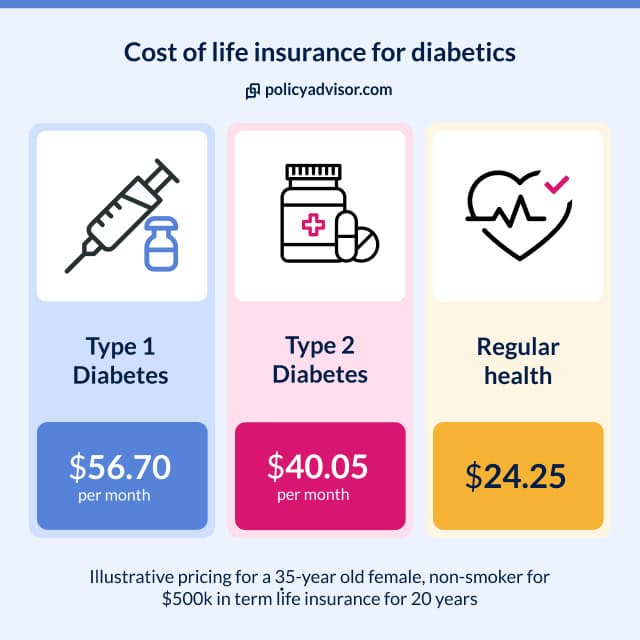

How much does life insurance cost for diabetics in Canada?

The cost of life insurance for diabetics in Canada varies based on several factors, including the type of diabetes, age, overall health, and the level of coverage required. Premiums may be higher than for individuals without diabetes due to the increased risk associated with the condition.

When is the best time for a diabetic to apply for life insurance in Canada?

The best time for a diabetic to apply for life insurance is when their diabetes is well-controlled and stable. Applying when you are younger and healthier can also help secure better rates. It is advantageous to apply after recent improvements in diabetes management or overall health.

Do all life insurance companies in Canada offer coverage for diabetics?

Not all life insurance companies in Canada offer coverage for diabetics. Some insurers specialize in high-risk cases and may provide coverage options tailored to diabetics. It is important to compare policies and work with a broker who can help find insurers willing to offer coverage.

Can diabetics get a life insurance policy if they have been turned down before?

Yes, diabetics can get life insurance if they have been turned down before or denied coverage. Read more about your life insurance options when your application has been declined.

1-888-601-9980

1-888-601-9980