Male: $33/month

*Based on standard profile

Sun Life stands out for long-term flexibility, offering term coverage from 5 year up to 40 years alongside underwriting tailored for those managing diabetes. Their plans can be customized with valuable add-ons like critical illness, accidental death benefit, waiver of premium, business protection, and more. Sun Life insurance plans also have built-in conversion options that let policy owners seamlessly switch from term to permanent coverage without new medical evidence. These features make Sun Life a top choice for adaptable and long-term protection.

Read our full review below to find out more about the company, the features they offer, and what we rate their life insurance products.

Our Sun Life insurance rating and review

Sun Life currently offers Sun Life Evolve Term Insurance as its primary fully underwritten term solution, built for flexible term lengths, higher coverage limits, and the ability to convert to permanent insurance as needs evolve.

Alongside Evolve, Sun Life also offers Sun Life Go and Sun Life Go Simplified, which focus on faster, online approvals and simplified underwriting. However, these options typically come with lower coverage limits, fewer customization features, and less structural flexibility compared to Evolve.

Sun Life also offered SunTerm and SunSpectrum Term previously as its traditional term life products, but both have been replaced by Sun Life Evolve Term as the insurer’s core fully underwritten solution.

You can renew your policy for another term once your first term is done, or you can change it into permanent life insurance. You also have a lot of life insurance rider options that can help you get a wide variety of coverage for an affordable rate.

Sun Life’s premiums can be slightly higher than those of some other companies. However, they also offer some of the highest coverage amounts in the Canadian market.

We would recommend Sun Life if you’re looking for a term life insurance product that offers strong flexibility (from a wide range of term length options to the ability to secure higher coverage amounts) while still giving you room to convert your coverage as your needs evolve.

Sun Life Insurance pros and cons

Here is what our team ranks as the most and least advantageous features of Sun Life’s term life insurance products for most Canadians.

Sun Life insurance pros

- Strong name brand recognition

- Multiple rider options available to help you maximize coverage for yourself and your family

- Lets you convert into permanent life insurance up to age 75; most other companies allow this only up to age 70 or 71

- Multiple options to convert into permanent life insurance: whole life or universal life

- Fully underwritten or non-medical coverage options available

- Flexibility to choose the coverage period that fits your needs (ranging from 5 to 40 years)

- Coverage amounts up to $25 million, one of the highest in the Canadian market

- Online application process

- Digital e-policy

Sun Life insurance cons

- Premiums can be higher than competitors’

- Underwriting can be strict if you have existing health concerns

About Sun Life Insurance

Sun Life Financial, Inc., founded in 1865, is one of the largest life insurance companies in the world. It was started in Montreal, Quebec, as The Sun Insurance Company of Montreal. In 1979 the company shifted its headquarters from Montreal to Toronto.

Today, Sun Life is a major financial company. It has offices in countries all over the world, including the U.S., the United Kingdom and Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda. It has 37,000 employees and sells products through more than 112,000 advisors.

Sun Life Assurance Company of Canada provides insurance and financial services like wealth and asset management. It has over $1.6 trillion CAD worth of assets under management (AUM) across the world.

How much does life insurance from Sun Life cost?

Sun Life’s term life insurance may be priced above some lower‑cost options, but it also gives you access to higher coverage limits, offering stronger protection for your loved ones. The table below shows Sun Life term insurance quotes at different ages for their default plan, for a 20-year term, and $500,000 in coverage.

You can easily get a personal Sun Life insurance quote and compare it with other companies right here on our website.

| Age | Male | Female |

|---|---|---|

| 30 | $33.30 | $26.10 |

| 35 | $35.10 | $28.80 |

| 40 | $52.65 | $40.50 |

| 45 | $82.80 | $59.40 |

| 50 | $141.75 | $95.85 |

| 55 | $259.20 | $176.40 |

| 60 | $469.80 | $322.20 |

| 65 | $718.20 | $498.60 |

*Representative values: premiums are based on non-smokers in good health, with a $500,000 benefit and a 20-year term.

What types of term life insurance policies does Sun Life Insurance offer?

Sun Life Insurance offers three different term life insurance products. We’ve provided some details on them below.

What other insurance policies does Sun Life Insurance offer?

Aside from term life insurance, Sun Life also sells the following products:

Permanent life insurance covers you for your entire life. Your premiums are guaranteed to stay the same as long as you have your policy. It’s also often called whole life insurance.

These types of plans also have an investment component that helps you build wealth during your lifetime.

Sun Life has 3 different types of permanent insurance options: non-participating, participating, and universal.

Critical illness insurance will give you a one-time lump-sum payment if you become sick with a serious illness and meet the policy requirements (including any survival period). Most insurance companies will pay out for 26 or more of the most common major diseases in Canada, like cancer, heart attack, stroke, and others.

Sun Life offers critical illness insurance for adults and children. The insurance provides comprehensive coverage in amounts from $25,000 to $4 million for adults and from $25,000 to $1 million for children.

They also give you a lot of options to customize your coverage, such as:

- Enhanced (covers 26 conditions) and children’s coverage (5 additional conditions) available

- 8 conditions are eligible for partial payouts

- Early detection is eligible for partial payment (10% of the benefit up to $50,000)

- Terms: 10 years and to age 75 and 100

- 10 and 15 year limited pay options

- Maximum coverage: $4 million for adults and up to $1 million for children

- Coverage for Loss of Independent Existence Included

- Return of Premium on death and expiry/cancellation available (after 15 years)

Disability insurance will help pay a big part of your paycheque if you become disabled and cannot work. It’s also called income protection insurance.

Sun Life has disability insurance options for sale. But you have to speak to an insurance broker to find out more information and get quotes for their disability insurance plans.

Private health insurance helps to pay for health care costs that your provincial or government health plan doesn’t. Most private health plans also help pay for dental costs.

Sun Life is a popular choice for group benefits through your job in Canada. A lot of companies use them to give benefits like private health insurance to their employees. They offer Basic, Standard, and Enhanced plans, with different levels of coverage.

Sun Life also lets you change your group health insurance to a policy you own if you leave the company, so you won’t lose your coverage. They let you do this easily without having to answer a lot of health questions or do a medical exam.

Long-term care insurance helps cover ongoing health-care and personal-assistance costs when you can no longer care for yourself, such as help with daily activities or supervision due to diminished physical or cognitive ability

Sun Life in Canada offers long-term care coverage through Sun Retirement Health Assist to protect against healthcare costs in retirement. It provides a monthly income-style benefit, paying between $125 and $2,300 per week.

Is Sun Life Insurance right for you?

Sun Life Insurance could be a good option for people who need reliable term life insurance and a high amount of coverage, like people with high net worth. It is also a good option for people looking for long term flexibility.

Sun Life offers strong brand name recognition and standard coverage that can be a good fit for a lot of Canadians. However, people who want to save as much money as possible should compare quotes from other providers who may be able to offer more affordable options.

At PolicyAdvisor, we work with more than 30 of the best insurance companies in Canada, including Sun Life. Speak to our licensed advisors, and we can help you decide if Sun Life’s products are the best fit for you.

How to buy Sun Life term life insurance policies?

You can buy life insurance with Sun Life on PolicyAdvisor.com. Use our free quoting tool or click the button below to get personalized quotes instantly. You can also compare those quotes with some of the other top companies for life insurance in Canada.

If you would prefer to speak with a licensed insurance agent, we can help with that too! Our experienced advisors would be happy to speak with you and give one-on-one advice.

Speak with a professional insurance advisor

As Canada’s best online life insurance advisor, we can help you compare and choose the company that matches your needs. Don’t hesitate to speak with our licensed advisors if you need help. We offer no-obligation advice to help you find your best match!

Frequently Asked Questions

What are the different term life insurance options available with Sun Life?

With Sun Life, you can choose from different term life insurance options. Based on your budget and coverage requirements, you can choose a suitable plan and get the most affordable price.

Is Sun Life a good insurance company?

Yes, Sun Life is a reputable insurance company. It has over $1 trillion CAD worth of assets under management (AUM) across the world, which demonstrates its stable financial strength. The company has also received an A+ rating as per A.M. Best ratings.

How is the cost of Sun Life insurance policy determined?

The cost of Sun Life insurance policy depends on the coverage, age, gender, riders, and a few other factors. Moreover, premiums for a non-smoker are lower than those for a smoker. You can consult our advisor to get the exact premium you need to pay for Sun Life insurance policy.

What happens if I miss Sun Life insurance premium payment?

Sun Life insurance policies usually include a grace period. If a policy lapses, reinstatement may be available within a specified window (subject to conditions). Check your policy contract for exact terms.

Sun Life Critical Illness Insurance Review 2026

Sun Life, a trusted name in Canadian insurance, is committed to helping you prepare for life’s uncertainties. Facing a critical illness can be overwhelming, but with Sun Life critical illness insurance, you can protect your finances to focus on what matters most: your health and recovery.

In this article, we’ll take you through the essentials of Sun Life’s critical illness insurance, its flexible coverage options, affordability, and valuable features designed to ease financial stress during challenging times.

What are the key features of Sun Life’s critical illness insurance?

Sun Life offers two critical illness insurance plans to meet different coverage needs. Sun Critical Illness Insurance is the most comprehensive plan, covering 26 full-payout illnesses, 8 partial-payout illnesses, and 5 full-payout childhood illnesses, covering up to $4,000,000 for adults and $1,000,000 for children.

For those seeking quick approval, Express Critical Illness Insurance provides an instant online application with no medical exams or blood work. This option covers 1, 3, or 7 full-payout illnesses based on the selected plan: basic, enhanced, or comfort.

This plan offers coverage amounts of $25,000 or $50,000 for adults, focusing on common critical illnesses like cancer, heart attacks, and strokes.

Key features of critical illness insurance from Sun Life

| Feature | Details |

| Coverage amount | $25,000 to $4,000,000 based on the plan and coverage type chosen |

| Conditions covered | 26 full-payout illnesses, 8 partial-payout illnesses, and 5 additional childhood illnesses (available with the Sun Critical Illness Insurance plan)

OR, 1, 3, or 7 full-payout illnesses based on the selected plan—basic, enhanced, or comfort (available with the Express Critical Illness Insurance plan) |

| Payout options | Lump-sum benefit upon diagnosis and survival of a covered illness |

| Partial payout benefits | Available for 8 specified minor illnesses, providing a reduced payout (only available with the Sun Critical Illness Insurance plan) |

| Return of premium | Optional return of premium benefits available on death, cancellation, or plan expiry |

What are the different critical illness insurance plans offered by Sun Life?

Sun Life offers two critical illness insurance plans, Sun Critical Illness Insurance and Express Critical Illness Insurance.

The Sun Critical Illness Insurance covers 26 full-payout illnesses, 8 partial-payout illnesses, and 5 full-payout childhood illnesses, offering coverage amounts of up to $4,000,000 for adults and $1,000,000 for children.

The Express Critical Illness Insurance provides an instant online application with no medical exams or blood work. This plan covers 1, 3, or 7 full-payout illnesses based on the selected plan: basic, enhanced, or comfort.

Sun Critical Illness Insurance

The Sun Critical Illness Insurance plan offers comprehensive coverage, providing financial protection for both adults and children facing serious medical conditions. Coverage amounts range from $25,000 to $4 million for adults and $25,000 to $1 million for children.

The adult plan covers 26 critical illnesses for full payout and 8 minor illnesses for partial payout, while the child plan includes an additional 5 illnesses. Policyholders also have access to Teladoc Medical Experts for medical guidance.

This plan from Sun Life covers adults aged between 18 and 65 years, and children aged between 30 days and 17 years. There are three term options available under this plan: Term 10 (T10), Term 75 (T75), and Lifetime (T100).

If you’re applying for Sun Critical Illness Insurance, a medical exam may be required as part of the application process.

Key features of Sun Critical Illness Insurance

| Feature | Details |

| Coverage amounts | Adults: $25,000 to $4 million, Children: $25,000 to $1 million |

| Illnesses covered | 26 full-payout, 8 partial-payout, 5 childhood illnesses |

| Plan options | Term 10, Term 75, Lifetime (T100) |

| Eligibility based on age | Adults: 18-65, Children: 30 days-17 years |

| Return of Premium | Available on cancellation, expiry, or death |

| Waiver benefits | Coverage continues if insured or policy owner becomes disabled or dies |

| Conversion options | Long-term care conversion available for ages 18-50 at the time of purchase |

Express Critical Illness Insurance

The Express Critical Illness Insurance plan provides financial protection in the event of a serious illness, offering a tax-free lump-sum payment upon diagnosis of a covered condition after a 30-day survival period.

This plan offers instant online approval with no medical exams or blood work required. Sun Life, through this plan, covers amounts of $25,000 or $50,000. Policyholders can choose from three plans: Basic, Enhanced, and Comfort, covering 1 to 7 critical illnesses.

The Comfort Plan offers additional benefits such as a five-year rate guarantee, inflation protection, and access to Teladoc Medical Experts. Coverage is available for individuals aged 18 to 65, with the option to add child coverage for a small additional cost of $2.50 per month.

This policy can be cancelled anytime, with a full refund available within the first 30 days.

Key features of Express Critical Illness Insurance

| Feature | Basic Plan | Enhanced Plan | Comfort Plan |

| Illnesses covered | Cancer | Cancer, Heart Attack, Stroke | Cancer, Heart Attack, Stroke, Coronary Artery Bypass Surgery, Aortic Surgery, Major Organ Transplant, Major Organ Failure on Waiting List |

| Age requirements | 18 – 65 years | 18 – 65 years | 18 – 65 years |

| Coverage amount | $25,000 | $25,000 | $50,000 |

| Additional benefits | – | – | 5-Year Rate Guarantee, Inflation Protection, Teladoc Medical Experts, Child Coverage ($5,000 per child for $2.50/month) |

Which conditions qualify for a partial payout under Sun Life Critical Illness Insurance?

The Sun Critical Illness Insurance plan provides partial benefit payouts for specific conditions, primarily focusing on early-stage or less severe forms of illnesses.

These include early-stage cancers, such as chronic lymphocytic leukemia (CLL) Rai stage 0, ductal carcinoma in situ of the breast, gastrointestinal stromal tumors classified as AJCC Stage 1, Grade 1 neuroendocrine tumors (carcinoid), papillary or follicular thyroid cancer stage T1, stage 1A malignant melanoma, and Stage A (T1a or T1b) prostate cancer.

Additionally, coronary angioplasty is eligible for a partial payout as well. The insured person is required to survive for 30 days following the date of the procedure.

When does my Express Critical Illness Insurance plan start and end?

Your Sun Life Express Critical Illness Insurance coverage begins immediately after your application’s approval. It remains in effect until any of the following occurs:

- A claim is paid

- The policy is cancelled

- The policy anniversary following the insured person’s 70th birthday

- The insured person passes away

- Premium payments are missed for 30 consecutive days

What are the critical illnesses covered by Sun Life?

Sun Life Critical Illness Insurance covers 26 full payout illnesses and 8 partial payout conditions under its Sun Critical Illness Insurance plan. Alternatively, it covers 7 critical illnesses under its Express Critical Illness Insurance plan.

Some of the covered conditions are life-threatening cancer, heart attack, stroke, coronary artery bypass surgery, and aortic surgery.

Critical illnesses covered by Sun Life

| Category | Illnesses |

| Neurological disorders | Acquired brain injury due to external trauma, Bacterial meningitis, Benign brain tumour, Coma, Dementia (including Alzheimer’s disease), Loss of independent existence (LOIE), Loss of speech, Motor neuron disease, Multiple sclerosis, Paralysis, Stroke |

| Cardiovascular conditions | Aortic surgery, Coronary artery bypass surgery, Heart attack, Heart valve replacement or repair |

| Cancer-related conditions | Cancer |

| Organ conditions | Kidney failure, Major organ transplant, Major organ failure on waiting list |

| Sensory impairments | Blindness, Deafness |

| Trauma-related conditions | Severe burns |

| Other disorders | Aplastic anemia, Loss of limbs, Occupational HIV infection, Parkinson’s disease (and specified atypical Parkinsonian disorders) |

| Only covered under the Express Plan | Cancer, Heart attack, Stroke, Coronary artery bypass surgery, Aortic surgery, Major organ transplant, Major organ failure on waiting list |

What conditions are excluded from Sun Life Critical Illness Insurance?

Sun Life’s Critical Illness Insurance has specific exclusions where benefits will not be paid, such as pre-existing conditions, self-inflicted injuries, elective procedures, war-related activities, hazardous behaviour, substance abuse, and certain non-life-threatening conditions.

- Pre-existing conditions: Diagnosed illnesses related to pre-existing conditions during the exclusionary period

- Self-inflicted injuries: Conditions caused by suicide or intentional self-harm

- Elective procedures: Illnesses resulting from elective plastic or cosmetic surgeries

- War and criminal activities: Illnesses caused by war, riots, insurrection, or criminal acts

- Hazardous activities: Conditions from engaging in dangerous or risky activities

- Substance abuse: Illnesses caused by intoxication or narcotics (unless prescribed)

- Specific conditions: Non-life-threatening cancers, benign brain tumors, or organ failures under specific circumstances

How much does Sun Life critical illness insurance cost?

The cost of Sun Life Critical Illness Insurance depends on factors like age, coverage amount, and smoking status. Premiums are generally lower for non-smokers compared to smokers, and rates increase as the insured person ages or opts for higher coverage amounts.

For instance, a 20-year-old male non-smoker pays approximately $15.26 per month for $50,000 in coverage, while the same coverage for a smoker costs $16.70 per month.

Here are the average monthly premiums for a 10-year term plan with coverage amounts of $50,000 and $100,000 for male smokers and non-smokers:

| Age | Coverage Amount | Monthly Premium (Male Smokers) | Monthly Premium (Male Non-Smokers) |

| 20 | $50,000 | $16.70 | $15.26 |

| 30 | $100,000 | $41.49 | $30.51 |

| 35 | $50,000 | $34.43 | $22.01 |

| 40 | $100,000 | $86.40 | $48.87 |

| 45 | $50,000 | $84.83 | $41.99 |

| 55 | $100,000 | $398.25 | $180.45 |

Can I cancel or modify my Sun Life critical illness insurance policy?

Yes, you can cancel or modify your Sun Life critical illness insurance policy with a simple process. If you cancel within the 30-day free look period, you will receive a full refund by submitting a written request along with any required documents.

After this period, cancellation is still possible by submitting a written request, but refunds depend on your policy terms, and all coverage will end immediately. To modify your policy, such as adjusting benefits or adding riders, you must contact Sun Life directly.

What are the pros and cons of Sun Life’s critical illness insurance?

Sun Life Critical Illness Insurance provides comprehensive coverage for up to 26 full-payout illnesses, with generous payouts ranging from $25,000 to $4 million.

It includes options for children’s coverage, an online application process, and the benefit of no survival period for many conditions. However, it has limited short-term coverage options, and higher premiums for certain features, such as return of premium riders.

Pros and cons of Sun Life critical illness insurance

| Pros | Cons |

| Comprehensive coverage for up to 26 illnesses | Limited short-term coverage options |

| Generous payouts from $25,000 to $4 million | High premiums for ROP riders |

| No survival period for several conditions | |

| Teladoc Medical Experts (medical consultations via a global physician network) | |

| Digital access for application and management |

How can I buy Sun Life critical illness insurance?

If you’re looking for affordable Sun Life critical illness insurance quotes, we recommend speaking to our licensed advisors to compare and find the best plan for your needs. With PolicyAdvisor, you’ll receive free instant quotes, the lowest rates in the market, and lifetime after-sales support.

Frequently asked questions

Can I cover my children under Sun Life Critical Illness Insurance?

Yes, Sun Life offers comprehensive coverage for children through policies ranging from $25,000 to $1 million. Their children-focussed plan covers conditions such as cerebral palsy, congenital heart disease, cystic fibrosis, muscular dystrophy, and type 1 diabetes mellitus till the age of 24.

Does Sun Life Critical Illness Insurance cover early-stage illnesses?

Yes, Sun Life provides partial benefit payouts for 8 early intervention conditions: chronic lymphocytic leukemia (CLL) Rai stage 0, ductal carcinoma in situ of the breast, gastrointestinal stromal tumors classified as AJCC Stage 1, Grade 1 neuroendocrine tumors (carcinoid), papillary or follicular thyroid cancer stage T1, stage 1A malignant melanoma, and Stage A (T1a or T1b) prostate cancer. Please note, that these illnesses are only covered under one of Sun Life’s plans: Sun Critical Illness Insurance.

What is the age limit for Sun Life critical illness insurance?

Sun Life offers critical illness coverage from the age of 18 till the age of 65. Children are covered between the ages of 30 days and 17 years. This may vary based on your specific plan and coverage type.

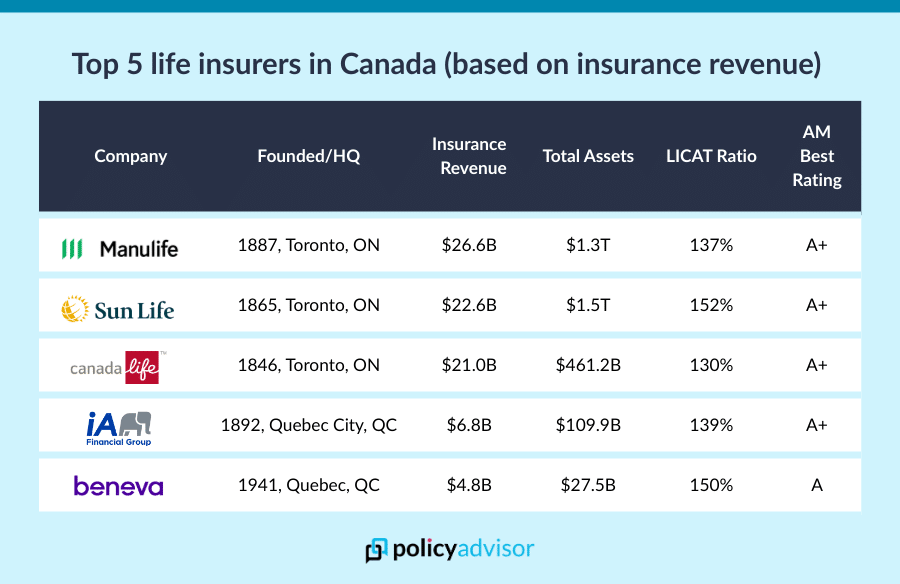

Biggest life insurance companies in Canada: A complete guide (2026)

Largest Life Insurance Companies in Canada (2026)

Here is a list of all 40 insurers, and further examine 28 leading companies to highlight their products, strengths, and key differentiators.

| Serial No. | Company | Founded / HQ | Insurance Revenue | Total Assets | LICAT Ratio | AM Best Rating |

| 1 | Manulife | 1887, Toronto, ON | $26.6B | $1.3T

|

137%

|

A+ |

| 2 | Sun Life | 1865, Toronto, ON | $22.6B | $1.5T | 152% | A+ |

| 3 | Canada Life | 1846, Toronto, ON | $21.0B | $461.2B | 130% | A+ |

| 4 | Industrial Alliance (iA) | 1892, Quebec City, QC | $6.8B | $109.9B | 139% | A+ |

| 5 | Beneva | 1941, Quebec, QC | $4.8B | $27.5B | 150% | A |

| 6 | Desjardins | 1948, Levis, QC | $4.3B | $470.9B | 146% | — |

| 7 | RBC Insurance | 1864, Toronto, ON | $2.3B | $28.6B | 135% | A |

| 8 | Empire Life | 1923, Kingston, ON | $1.4B | $19.7B | 151% | A |

| 9 | BMO Life | 1817, Toronto, ON | $1.3B | $20.1B | 130% | A |

| 10 | The Co-operators | 1945, Guelph, ON | $1.0B | $10.5B | 168% | A |

| 11 | Securian Canada | 1955, Toronto, ON | $990M | $1.2B | 153% | A |

| 12 | Equitable Life | 1920, Waterloo, ON | $920M | $10.2B | 169% | A |

| 13 | ivari | 1927, Toronto, ON | $822M | $14.6B | 131% | A+ |

| 14 | Blue Cross Canada | 1939, Various | $686M | $2.3B | 135% | A- |

| 15 | Brookfield/Blumont Annuity Co. | Toronto, ON | $383M | $7.5B | 147% | — |

| 16 | Primerica | 1977, Duluth, GA | $359M | $4.1B | 191% | A+ |

| 17 | Chubb Life | 1882, Toronto, ON | $342M | $345M | 163% | A+ |

| 18 | Metropolitan Tower | New York, NY, USA | $331M | $2.3B | 171% | A+ |

| 19 | Wawanesa | 1896, Wawanesa, MB | $300M | $11.5B | 165% | A |

| 20 | Foresters | 1874, Toronto, ON | $0.2B | $1.8B | 200% | A |

| 21 | Combined of America | 1922, Chicago, IL | $230M | $1.1B | 176% | A+ |

| 22 | UV Insurance | 1889, Drummondville, QC | $225M | $2.4B | 172% | — |

| 23 | Humania | 1874, QC | $200M | $678M | 185% | A+ |

| 24 | TD Life | 1855, Toronto, ON | $155M | $344M | 200% | — |

| 25 | Assumption Life | 1903, Moncton, NB | $147M | $2.3B | 165% | A- |

| 26 | TruStage Life | 1902, Toronto, ON | $120M | $2.4B | 165% | A- |

| 27 | CIGNA Life | 1982, Bloomfield, CT | $111M | $136M | 245% | A |

| 28 | British Insurance Co. (Cayman) | Cayman Islands | $77M | $471M | 176% | — |

| 29 | Knights of Columbus | 1882, New Haven, CT | $76M | $30.3B | 274% | A+ |

| 30 | American Income Life | 1951, Waco, TX | $71M | $64M | 169% | A+ |

| 31 | New York Life | 1845, New York, NY | $42M | $696M | 353% | A++ |

| 32 | CIBC Life | 1961, Toronto, ON | $29M | $164M | 494% | — |

| 33 | Aetna Life | 1939, Toronto, ON | $28M | $98M | 496% | A |

| 34 | Teachers Life | 1972, Waterloo, ON | $25M | — | 234% | — |

| 35 | Serenia Life | 1972, Waterloo, ON | $20M | $371M | 177% | — |

| 36 | American Health & Life | 1954, Fort Worth, TX | $17M | $64M | 576% | A- |

| 37 | AWP Health & Life SA | Paris, France | $15M | $38M | 271% | — |

| 38 | Connecticut General | 1957, Bloomfield, CT | $4M | $195M | 223% | A |

| 39 | Reliable Life | 1887, Hamilton, ON | $3M | $14M | 310% | — |

| 40 | Jackson National Life | 1961, Lansing, MI | $254K | $11M | 458% | A |

* Methodology and sources for the above table

We standardize “revenue” as Insurance Service Revenue under IFRS 17 and reconcile across sources. Where company-year figures differ, we use the latest audited report and note variances in footnotes.

- Office of the Superintendent of Financial Institutions (OSFI) financial data (2024)

- A.M. Best Financial ratings (2025)

- Company annual reports

Your benefits are protected: If a member life insurer fails, Assuris protects your policy up to $1,000,000 or 90% of the death benefit, whichever is higher. This safety net applies to most Canadians.

1. Manulife

Manulife Financial Corporation is one of the largest life insurers in Canada, and also one of the most globally recognized, with operations in Canada, the U.S. (through John Hancock), and multiple Asian markets. Founded in 1887, the company manages approximately $1.3 trillion assets under management and administration globally.

2. Sun Life

Sun Life Financial, Inc. is one of the largest life insurers in the world, and also one of the oldest, with a history spanning back to 1865.

Apart from Canada, they have a presence in the U.S. and in seven Asian markets, including China and India.

3. Canada Life

Canada Life is one of the oldest and most stable life insurers in the country. Up until recently, it came second to Manulife in the number of annual premiums, which was no surprise given that Manulife is one of the largest companies in the world.

In 2020, Great West Life merged with its sister companies, London Life and Canada Life, into the single Canada Life Assurance Company brand. That merger pushed Canada Life to the top of the charts.

4. iA (Industrial Alliance)

iA (Industrial Alliance) Financial Group is one of the largest insurance and wealth management groups in Canada. They also have operations in the United States. It was founded in 1892 and offers both individual and group benefits products.

iA is more than an insurance company; they also work in property management and real estate. They rent out many office spaces in major cities across Canada.

5. Beneva

Beneva, formed from the merger of Quebec-based SSQ Insurance and La Capitale, ranks among Canada’s top mid-tier life insurers by assets (~$27.5B) and regional presence.

SSQ Insurance was founded in 1944, while La Capitale was founded just a few years earlier, in 1940. Both companies were founded and operated on mutualist values, which have carried on with their merger into Beneva. This makes it one of the biggest mutual insurance companies in the country.

6. Desjardins

Desjardins is well known across Canada, offering a wide variety of financial services and insurance products.

The company mainly focuses on life, health, and home insurance, and wealth management services. They also offer business services like point-of-sale payments and cash management.

7. RBC Insurance

The Royal Bank of Canada (RBC) is one of North America’s most well-known financial institutions. RBC Insurance is the division that provides insurance products and services to individuals and businesses across Canada.

8. Wawanesa

Wawanesa Mutual is the parent company of Wawanesa Insurance, which sells life and other insurance products. Founded in 1896 and based in Winnipeg, Manitoba, the company also operates as Wawanesa General in the United States, primarily selling property and casualty insurance in California and Oregon.

9. BMO

BMO Financial Group is one of the largest financial institutions in Canada, if not the world. It was founded in 1817 as the Bank of Montreal.

BMO Insurance is a part of BMO that sells insurance policies and similar services.

10. Equitable Life

Equitable Life Insurance Canada is a federally regulated mutual life insurer, governed by federal rules. Like Beneva and Wawanesa, Equitable is also a mutual company that is partly owned by some of its clients.

11. Empire Life

Empire Life was founded in Kingston, Ontario, in 1936. The company operates services, sales, and marketing centres throughout Canada. They are most well known for their permanent participating life insurance policies.

12. Foresters

Foresters Financial is a company that offers financial services in Canada, the US, and the UK. It was founded over 140 years ago, in 1870. Many of Foresters’ life insurance products help charities.

Many of its life insurance products support charities through claims, grants, or special programs. Foresters underwrite the insurance policies offered by Canada Protection Plan.

13. Co-operators

The Co-operators Group Limited is a leading Canadian co-operative company. They offer a wide range of insurance and financial services, mostly through a network of financial advisors and brokers.

14. ivari

ivari (formerly Transamerica Life Canada) was acquired by Wilton Re in 2015. They have been operating for more than 80 years, offering a variety of insurance policies and investment products.

15. Blue Cross

There are many different Blue Cross member plans in Canada. The Canadian Association of Blue Cross Plans is the group that represents all of them nationally.

Blue Cross is best known for group insurance and travel insurance. Canadians who are Blue Cross members can save money on insurance for various services, including vision, medical, and more, through their Blue Advantage program.

16. Securian Canada

Most people know Securian Canada by its old name, Canadian Premier Life. It is a company that offers financial management services and several insurance products.

17. Primerica

The Primerica Canada Insurance Company was started in 1986. It is a subsidiary of Primerica Life Insurance Company, offering insurance and other financial services.

18. Chubb Life

Chubb Life Insurance Company was founded in 1882. Now, they are a trusted and reliable provider of insurance in Canada. They have offices in Ontario, Quebec, Alberta, and British Columbia.

19. TruStage Life (Assurant Life)

The insurance company known as Assurant Life rebranded into TruStage in 2022 after it was bought by CUNA Mutual Group.

As an insurance company, they specialized in selling insurance for end-of-life planning, like funeral insurance and executor protection insurance. They also offer services like assessing and handling final documents (wills, trusts, etc.).

20. Combined Insurance Company of America

Combined Insurance Company of America is owned by Chubb Insurance Company in the US. It was founded in 1922 and sells insurance to people and businesses.

21. UV Insurance

UV Insurance, formerly known as UL Mutual, was founded in 1889 in Quebec.

22. Assumption Life

Assumption Life is best known for its no-medical term life plans. They were founded in 1903 in New Brunswick, Canada. But they were originally a fraternal society in Massachusetts, USA, before they decided to start selling insurance.

23. Knights of Columbus

Knights of Columbus is a Catholic fraternal organization founded in 1882 as a mutual benefit society for Catholic people who moved to the US. It provides coverage for members and their families, offers insurance and financial services, and actively engages in charitable work.

24. Humania

Humania Assurance was founded in Quebec in 1874 as a mutual society. They offer a lot of no medical life insurance options and are best known for how quickly they issue policies.

25. American Income Life

American Income Life was founded in 1951. The company now sells insurance in Canada, the US, and New Zealand. They focus on helping working families and members of credit unions, labour unions, and other associations get insured.

26. Serenia Life

Serenia Life is a U.S. fraternal benefit society that sells insurance in Canada. It was founded in 1972 and used to be called Faithlife Financial up until 2008. Their company is inspired by Christian values.

27. CIBC

CIBC Insurance is a part of CIBC (the Canadian Imperial Bank of Commerce), one of Canada’s biggest banks. The bank itself was formed in 1961 after two older Canadian banks merged into one. They later started selling insurance products too.

28. Reliable Life

Reliable Life has been helping Canadians with insurance since 1887. They are also part of a company called the Old Republic International Corporation, which is listed on the New York Stock Exchange. Reliable Life mostly sells travel insurance and accident insurance for students.

What’s new in our 2026 insurance company rankings?

For 2026, we’ve updated how we compare the biggest and best insurance companies in Canada to give a more complete and accurate picture.

Our updated approach looks beyond size and reputation. We now focus on financial strength, product quality, and customer satisfaction.

- We measure financial strength by looking at each insurer’s total assets, LICAT ratio (a key solvency indicator), and credit ratings from AM Best, S&P, and Moody’s. This helps us understand how stable and reliable each company is when it comes to paying claims.

- We also evaluate the range and flexibility of insurance products available, including life, health, and supplemental coverage. Insurers offering more customization, modern features, and digital tools score higher in this area.

- Lastly, we consider the customer experience—from how quickly claims are paid to how easy it is to manage your policy online. We review third-party ratings, client feedback, and the overall quality of digital services.

This new ranking system makes it easier for you to compare insurance companies in Canada and find the one that fits your needs best.

IFRS 17: How it changes reported revenue in 2026 rankings

International Financial Reporting Standard 17 (IFRS 17) replaced IFRS 4 (Insurance Contracts) for Canadian life insurers beginning January 1, 2023. It requires companies to recognize revenue based on the value of insurance services provided over time rather than on gross premiums received. This change often results in lower headline revenue numbers under the new standard, reflecting a more transparent and economically relevant view of insurance operations.

What it means for policyholders:

IFRS 17 does not change your premiums or coverage. You still receive the same benefits. However, it gives you a clearer view of how insurers manage risk and earn profits.

For investors, this standard improves transparency, reduces earnings volatility, and provides better insight into long-term financial performance.

How to choose the right insurer

When comparing the top life insurance companies in Canada, it’s important to go beyond size and brand recognition. Choosing the right provider means assessing financial strength, coverage options, premium affordability, and regional relevance.

Whether you are a young family, business owner, retiree, or high-net-worth individual, matching your needs with the right insurer can lead to better protection and long-term value.

| Category | What to look for |

| Financial strength |

|

| Coverage needs |

|

| Premium affordability |

|

| Digital and human support |

|

Is it better to choose a bigger insurance company?

Buying a policy from one of the biggest insurance companies in Canada may not always be the best choice. Just because a company is the biggest, it does not mean that it is the right company for your needs. Sometimes, going with a smaller company may be to your advantage.

This is why it is best to speak with our licensed advisors. They have intimate knowledge of the Canadian insurance market and can recommend the best provider for your specific needs.

Comparing large vs. small insurance companies

Choosing the right insurer depends on what matters most to you. Larger companies offer scale, extensive coverage options, and advanced technology, while smaller companies provide personalized service, flexible products, and local expertise. The table below highlights key differences to help you decide.

| Feature | Big insurance | Small insurance |

| Experience | Decades of industry expertise | Stable, often niche-focused |

| Coverage Options | Term & permanent, high limits | Tailored products, flexible riders |

| Price | Slightly higher, depends on scale | Competitive, sometimes lower |

| Customer Service | Fast, multiple offices & agents | Personalized, flexible, responsive |

| Accessibility | Extended hours, nationwide | Limited locations/hours |

| Technology | Advanced tools for quotes, claims, policy management | Simpler tech, more customization |

| Values & Ethics | Standard corporate practices | Local, mutual, or ethically aligned |

Still looking for the top insurance companies in Canada?

If you’re still not sure whether one of the largest Canadian insurance companies is right for you, our advisors are happy to help you out! Schedule a call and let our experts answer your questions about what is offered by Canadian insurance companies, big and small.

Online insurance brokers like PolicyAdvisor.com let you compare insurance quotes from 30 of the country’s best insurance companies. Schedule a call or try out our instant insurance quoting tools to see how much you can save by comparing quotes online

Frequently asked questions

How often do rankings of life insurance companies change?

Rankings can change annually or even more frequently, depending on factors like financial performance, customer service ratings, innovation, and regulatory changes. A company’s solvency, claims handling, and market share can all influence its position in industry reports or consumer rankings.

What factors affect the financial stability of life insurance companies?

Financial stability is typically measured by solvency ratios, capital reserves, investment performance, and underwriting profits. Companies with diverse investment portfolios, strong risk management practices, and consistent profitability are generally more stable and reliable over the long term.

Can I buy life insurance from a company not based in Canada?

You can only purchase life insurance from international companies that are licensed to operate in Canada. These insurers must comply with Canadian regulations and are monitored by federal or provincial insurance regulators. Buying from an unlicensed foreign insurer could leave you unprotected or unable to enforce your policy.

What are the benefits of choosing a large life insurance company over a smaller one?

Large insurers often offer a wider range of products, stronger digital platforms, and greater financial stability. They may also have more streamlined claims processes and better access to additional services, such as financial planning tools or wellness programs. However, smaller insurers may provide more personalized service or competitive pricing.

How do consumer ratings affect life insurance companies?

Consumer ratings influence a company’s reputation and can guide potential customers during their decision-making process. Positive reviews can enhance trust, while repeated complaints may raise concerns. While not the sole factor, consumer feedback is a helpful indicator of service quality and client satisfaction.

What should I do if I am not satisfied with my life insurance provider?

You should begin by reviewing your policy, identifying specific concerns and contacting your insurer’s customer service to discuss your issue. If the problem persists, you can file a complaint with your provincial insurance regulator. If you are considering switching providers, ensure your new policy is active before cancelling the old one to avoid any coverage gaps.

Which are the best insurance companies in Canada for 2026?

The best insurance companies in Canada for 2026 are determined by their financial strength, customer satisfaction, product innovation, and digital capabilities. Leading providers include:

- Sun Life, for strong client satisfaction and wellness-focused products

- Manulife, for innovation and global reach

- Canada Life, for scale and comprehensive coverage options

- Industrial Alliance, for regional expertise and competitive pricing

- Beneva, for a mutual insurance company

How do I choose between the largest insurance companies in Canada?

Choosing the right insurer involves assessing several factors such as financial strength (A.M. Best ratings and LICAT ratios), product suitability based on your needs, pricing competitiveness, quality of service and claims experience, and access to digital tools for convenience and support.

Are bigger insurance companies always better?

Larger insurance companies offer advantages such as financial stability, broad product availability, and extensive support networks. However, they may not always be the best fit. Smaller or regional insurers can provide more competitive pricing, personalized service, and flexible options tailored to specific needs.

What is the difference between the top 10 and top 20 insurance companies in Canada?

The top 10 insurers are typically national leaders with large-scale operations and diversified offerings. The top 20 includes regional and specialized insurers that may excel in niche markets or offer unique advantages in pricing, service, or policy design.

How often do rankings of the biggest insurance companies change?

Rankings among Canada’s top five life insurers tend to remain consistent year over year. However, changes can occur due to mergers, premium growth, or shifts in market strategy. Notably, Canada Life’s position strengthened following its merger with Great-West Life and London Life.

Can I trust the financial ratings of Canada’s largest insurance companies?

Yes. Canada’s major insurers are rated by independent global agencies such as A.M. Best, Moody’s, S&P Global, and DBRS Morningstar. These ratings reflect a company’s financial strength, claims-paying ability, and long-term stability, and are reviewed regularly.

Do the top Canadian life insurance companies operate nationwide?

Yes, all top life insurance companies in Canada are licensed to operate nationwide. While some have stronger regional footprints, such as Desjardins and iA in Quebec or Wawanesa in the West, they serve clients across the country either directly or through licensed advisors.

What makes the best insurance companies in Canada in 2026 different from previous years?

Top insurers in 2026 are distinguished by their investment in digital transformation, faster underwriting through AI, integrated wellness and health features, ESG investment practices, and personalized insurance solutions using data and analytics. These enhancements improve both accessibility and client experience.

BMO Life Insurance Review – Updated 2025

BMO Term Life Insurance offers simple, affordable coverage backed by one of Canada’s oldest and most trusted banks, Bank of Montreal. BMO term life insurance offers a variety of term lengths (Term 10, Term 15, Term 20, Term 25, and Term 30), flexible plan exchange options, coverage up to $30 million, and more such features.

In this updated 2025 review, we’ll break down BMO’s term life options, highlight key benefits, and discuss the cost of purchasing this policy. If you’re weighing your life insurance choices, this review will help you decide if BMO’s term life coverage is the right fit for your needs.

Who is BMO Insurance?

BMO Insurance is a member of the BMO Financial Group, which was founded in 1817, and is another of Canada’s largest financial institutions. Operating as a separate business unit, BMO Insurance offers term and permanent life insurance, accident, travel, and critical illness insurance. BMO Insurance also offers income annuities and guaranteed investment funds. The BMO Life Assurance Company portfolio was bolstered by the acquisition of AIG’s life insurance business in 2009.

Key facts about BMO Life Assurance Company

When was BMO Insurance founded? 1817

Where is BMO Insurance’s headquarters? Toronto, Ontario

AM Best Rating: A (Excellent)

Better Business Bureau Accreditation and Rating: N/A

Assets: $11.2-billion

Annual Premiums: $ 2.0 billion

Website: bmo.com/insurance

What are the key features of BMO term life insurance?

BMO term life insurance offers flexible coverage, catering to a wide range of policyholders and their unique needs. The coverage types include single policies, combined policies, and joint-last-to-die policies. BMO offers term lengths spanning from 10 to 30 years and coverage amounts ranging from $100,000 to $30 million.

Policies are renewable and convertible to permanent life insurance up to the age of 71 without additional medical exams. BMO’s optional riders, such as critical illness benefits and waiver of premium, make its term life insurance a comprehensive choice for Canadians.

Key features of BMO term life insurance

| Feature | Details |

| Term lengths | 10, 15, 20, 25, and 30 years |

| Coverage type |

|

| Coverage amounts | $100,000 to $30 million |

| Eligibility age |

|

| Policy expiry age | Coverage expires at age 85 |

| Renewability | All plans are renewable |

| Convertibility | Convertible to permanent life insurance without medical exams before age 71 |

| Exchange option | 10-year and 15-year term policies can avail full or partial exchange options for longer terms within the first 5 years |

| Optional riders | Critical illness benefit (available if under 60 at application) for both single and joint plans

Additional riders for single policies

Additional riders for joint policies

|

| Medical Exam Requirement | No medical exam required for coverage amounts under $250,000 for applicants aged 18 to 65; health questionnaire required |

| Premiums | Guaranteed level premiums for the duration of the term |

| Under-writing classifications |

|

| AM Best Rating | A |

Our BMO life insurance rating and review

BMO Insurance’s term life insurance is a great option for individuals, couples, or business owners. It can cover mortgages and other debts, final expenses like funeral expenses, replace future income, and provide for dependents. The plan can also be used to protect businesses and their key employees. Lastly, the death benefit can be used to leave a financial gift to a favourite charity.

BMO Insurance term life insurance policies offer terms ranging from 10 to 30 years. Death benefits (tax-free payments to a beneficiary) can go all the way up to $10,000,000. All term life plans can be converted to a permanent life insurance policy at any time before age 70. Term 10 plans can be exchanged for longer terms: Term 15, 20, 25, or 30. Term 10, 15, and 20-year plans are renewable and convertible. Term 25 and 30 plans are convertible, although not renewable.

There are riders for critical illness insurance, accidental death insurance, and waiver of premium in case of disability. One can also add a children’s life insurance rider.

Another great feature of BMO Insurance is its unique Compassionate Benefit Program. This is a non-contractual cash benefit offered by BMO Insurance to term life policyholders with a limited life expectancy who may require a source of funds to help them manage their medical bills and unexpected financial costs.

For term life policyholders, an initial advance of up to 50% of the base coverage (maximum of $250,000) may be paid out if the policyholder is diagnosed with a terminal illness with a life expectancy of 12 months or less. This is available on individually-owned single and joint life policies as well (max of 2 insure with joint ownership policies).

What types of term life insurance policies does BMO Insurance offer?

BMO Insurance offers its Term Life insurance product with many options, such as Term 10, Term 15, Term 20, Term 25, and Term 30 plans to personalize coverage for those applying.

Medical underwriting is generally required, depending on the age of the applicant and the amount of insurance applied for

Premiums are guaranteed

Term 10 plans have an exchange program, where the policyholder can renew for another eligible term policy after 1 year but before 5 years of their initial term 10 coverage.

There are riders for critical illness, accidental death, and waiver of premium in case of disability. One can also add a children’s life insurance rider.

Coverage types offered by BMO term life insurance

BMO Insurance offers three primary coverage types within its term life insurance policies, including single and joint policies, allowing policyholders to select the structure that best fits their personal or family needs:

- Single Life: Covers one individual; the death benefit is paid upon the death of the insured

- Combined Life: Covers two individuals; the death benefit is paid upon the death of each insured person

- Joint Last-to-Die: Covers two individuals; the death benefit is paid upon the death of the last surviving insured person

How much does BMO term life insurance cost?

The cost of your BMO term life insurance policy will depend on factors such as your age, gender, health history, smoking status, and the type of coverage that you’re opting for.

Typically, the monthly cost of term life insurance for a non-smoker in good health seeking $500,000 in coverage for a 20-year term plan can range between $31 to $681 for male individuals and $21 to $479 for female individuals.

Monthly cost of BMO term life insurance for various age groups

| Age | Male | Female |

| 20 | $31.95/mo | $21.60/mo |

| 25 | $32.40/mo | $22.05/mo |

| 30 | $32.85/mo | $22.95/mo |

| 35 | $33.30/mo | $26.10/mo |

| 40 | $49.05/mo | $36.90/mo |

| 45 | $76.95/mo | $55.80/mo |

| 50 | $131.40/mo | $91.80/mo |

| 55 | $242.10/mo | $166.95/mo |

| 60 | $427.50/mo | $305.10/mo |

| 65 | $681.75/mo | $479.25/mo |

*Illustrated the cost of premiums for a non-smoker in good health seeking $500,000 in coverage for a 20-year term plan

What is the Term Exchange Program offered by BMO insurance?

BMO’s Term Exchange Program allows individuals with a Term 10 or Term 15 policy to exchange their existing coverage for a longer-term policy—Term 15, 20, 25, or 30—without the requirement for additional medical underwriting.

The exchange can be initiated on or after the 1st policy anniversary if you’re opting for a full exchange. In case you’re opting for a partial exchange, the initiation should be made on or after the 2nd policy anniversary.

Some of the benefits of the Term Exchange Program include:

- No additional medical underwriting: Policyholders can adjust their coverage without undergoing a new medical examination, simplifying the process

- Extended coverage: Provides the opportunity to secure a longer-term policy, ensuring continued protection as long as needed.

- Flexible adjustment: Allows for both full and partial exchanges, accommodating varying coverage needs

What other insurance policies does BMO Insurance offer?

In addition to Term plans, BMO Insurance also offers whole life insurance, universal life insurance, permanent life insurance, critical illness insurance, travel insurance, and more. Policyholders can opt for one or more policies based on their specific needs.

Permanent life insurance

Permanent life insurance provides you with coverage from the day the policy is settled until the day you die. As long as you pay premiums into the policy, BMO life insurance coverage never expires.

BMO Insurance offers several different permanent life insurance policies:

EasyOne Life

- Available to Canadians between the ages of 50 and 80 who have no serious illnesses

- No medical exam required and immediate permanent life insurance coverage from the day BMO Life Insurance receives your application

- Lifelong coverage with a tax-free benefit between $5,000 and $50,000

Guaranteed-Life Plus

- Available to Canadians between the ages of 45 and 75

- Guaranteed life insurance coverage and no medical exams or health questionnaires required

- Lifetime coverage as long as payments are paid up to age 95

- $50,000 in basic coverage (after 2 years without claims) and $250,000 accidental death coverage

Term 100

- Lifelong permanent life insurance coverage

- Fixed level premiums, which you pay until age 100

- Coverage amounts available between $50,000 and $5,000,000

- Much like BMO Insurance’s term life insurance policies, many optional riders are available for Term 100 to meet varied insurance needs

Whole life insurance

- Guaranteed cash value, and guaranteed premiums payable for 10 or 20 years or to age 100

- Non-participating permanent life insurance

- Unique features like premium switching, premium offset, additional payments, and policy loans make it a very flexible BMO life insurance coverage option

- Two plan options (Estate Protector and Wealth Accelerator) to service different end-of-life financial needs

Universal life insurance

Universal life insurance is like whole life insurance, except there is a self-directed long-term investment component: your insurer gives you options for investing the cash value of your policy.

BMO Life Insurance’s universal coverage offers three different universal life insurance policies: Life Dimensions, Life Dimensions (Low Fees) and Wealth Dimensions.

All these options boast:

- Flexible premiums and terms

- Extensive investment options

- Early access to cash-value

- Optional riders for more BMO life insurance coverage:

- term life insurance rider

- accidental death rider

- waiver of premium

- children’s term life insurance rider

- critical illness insurance rider

Critical illness insurance

Critical illness insurance is a living benefit insurance policy that pays out a tax-free lump sum if you develop a specified illness, health event, or undergo treatment while under its coverage, after a minimum of 30 days from when you are first diagnosed (90 days for cancer). This coverage is available for a period of time, also known as term length, and you determine it when purchasing the policy.

BMO Insurance offers 2 different critical illness insurance policies.

Life Recovery Plus

- Basic and enhanced plans that offer $25,000 and $50,000 in coverage, respectively

- Guaranteed acceptance when you provide a declaration of health

- Cash benefits are a mix of one-time, monthly, and daily benefits to help you financially while you recover

- The survival period is 30 days

Living Benefit

- Offers enhanced coverage (25 life-threatening medical conditions)

- Maximum coverage is $2 million

- Offers coverage for loss of independent existence and partial payouts for 7 different conditions

- The survival period is 30 days

- Available in 10 and 20-year terms or coverage up to 75 or 100 years of age

- There is a 15-pay option available on some policies

For more information and an in-depth look at their critical illness coverage, read our BMO Insurance Critical Illness Insurance Review.

BMO travel insurance

BMO Insurance offers travel insurance on a per-trip and annual basis, with different plans offering coverage for medical emergencies, trip cancellation, flight delays, lost baggage, and more.

Investment products and other financial products

Besides insurance, BMO Financial Group offers countless investment solutions and personal financial products as well as business banking solutions.

What are the pros and cons of BMO life insurance?

BMO’s term life insurance has several advantages in terms of affordable pricing, multiple coverage types and lengths, easy term exchange policy for a 10 and 15-year plan, comprehensive benefits package, and more. However, the only disadvantage is in terms of not having a digital policy option and an online account facility.

Pros and cons of BMO term life insurance

| Pros | Cons |

| Value for money pricing | No online account |

| Multiple term life insurance lengths, flexible coverage options | Only issues paper policies, no digital option |

| Ability to exchange a 10-year policy into a longer term policy (15, 20, 25, and 30-year coverage options) | |

| Comprehensive benefits like the compassionate benefit program allow advancement of the term life insurance coverage amount for policyholders needing financial support while dealing with a terminal illness | |

| Options to convert into multiple types of permanent insurance policies |

Is BMO Insurance the right fit for you?

BMO Insurance offers unique life insurance coverage products that are a great fit for many Canadians. As insurance advisors for BMO Insurance’s life insurance products, we can help you decide if BMO Insurance products are the best fit for you and find you instant quotes.

Canadians commonly use BMO Life Insurance policies to cover lines of credit, funeral costs, the outstanding balance on credit cards, provide peace of mind, secure future education for dependents, or augment their current life insurance plans. If you’re not sure how much coverage you need, check out our life insurance calculator or read more in our insurance learning centre.

As Canada’s best online insurance advisor, we can assist you in comparing and choosing products across all our partner companies. Speak to our licensed insurance advisors, and we will be able to help you find the best coverage for your needs and answer any questions you have about BMO term life insurance, permanent life insurance, critical illness and disability protection, simplified coverage without medical exams, and more.

Frequently asked questions

Can I increase my BMO term life coverage after the policy starts?

No, BMO does not permit increasing the coverage amount mid-term. To obtain additional coverage, you would need to apply for a new policy. However, exchange options are available for 10 and 15-year policies.

- For a 10-year term policy: You can exchange for higher term plans such as Term 15, Term 20, Term 25, or Term 30 policies

- For a 15-year term policy: You can exchange for higher term plans such as Term 20, Term 25, or Term 30 policies

These exchanges can be availed within the first 5 policy years without providing new medical evidence.

What happens if I outlive my BMO term life insurance policy?

If you outlive your term and choose not to renew or convert the policy, the coverage ends, and no benefits are paid out. BMO allows renewal up to age 85 and conversion to permanent life insurance before age 71, providing options to maintain coverage as your needs evolve.

Is BMO term life insurance suitable for business protection?

Yes, BMO’s term life insurance can be an effective tool for business protection. It can be used for purposes such as funding buy-sell agreements, covering business loans, or insuring key personnel.

BMO offers high coverage limits (up to $30 million) and fixed premiums, making it suitable for small to medium-sized businesses seeking predictable costs.

Does BMO offer joint term life insurance for couples?

Yes, BMO offers joint term life insurance for couples through two distinct policy types: Combined Life Coverage and Joint Last-to-Die Coverage. Combined coverage insures two individuals under a single policy, providing a death benefit upon the death of each insured person. After the first death takes place, the policy continues to cover the surviving insured individual.

Joint Last-to-Die Coverage, on the other hand, also covers two lives but pays out the death benefit only after both insured individuals have passed away. This type of coverage is often used for estate planning purposes, as it provides funds to cover estate taxes or to leave a legacy to beneficiaries.

La Capitale life insurance review – Updated 2025

La Capitale, now part of Beneva following its merger with SSQ Insurance, is a well-established provider of life insurance in Canada. Known for its diverse range of life insurance products, La Capitale caters to individuals, families, and business owners alike.

In this review, we’ll explore the key features of La Capitale’s life insurance offerings, their benefits, policy costs, and how they compare to competitors. Whether you’re looking for affordable term coverage or lifelong protection with cash value growth, this guide will help you determine if La Capitale is the right choice for your insurance needs.

What is La Capitale insurance?

La Capitale is a Canadian insurance provider that offers a range of life insurance products, including term life, whole life, and universal life insurance. Later, La Capitale merged with SSQ Insurance in 2020 to form Beneva Inc.

Despite the rebranding, La Capitale’s life insurance policies continue to provide financial protection for individuals, families, and business owners. The payout can cover final expenses, replace lost income, and ensure financial security for beneficiaries.

Key facts about La Capitale Life Insurance

- Founded: 1940

- Headquarters: Québec City, Québec

- AM Best Rating: —

- Better Business Bureau Accreditation and Rating: No / —

- Assets: $25 billion (2020) under Beneva

- Annual Premiums: $6 billion (2020) under Beneva

- Annual Premiums: $2.5-billion

La Capitale life insurance rating and review

La Capitale’s flagship product is their Enhanced term insurance, which automatically includes a Loss of Autonomy benefit and coverage for estate fees up to $1000 (Quebec only). This product is renewable and convertible and can be combined with Beneva’s full suite of insurance products such as critical illness insurance, disability insurance, and other savings and investment products.

La Capitale also offers a more basic term life insurance product, known as their “Pure” series product line. This term life insurance offers similar coverage amounts and convertibility compared with the Enhanced series but is a little cheaper as it does not come with the Loss of Autonomy or Succession Advantage benefit.

La Capitale also offers simplified and no-medical life insurance products, meaning no medical exam is required. For their simplified life insurance product, known as “Simplified Advantage,” coverage is available up to $100,000.

You can apply for their no-medical product, called “Affirmative,” after answering only four qualifying questions—but, their no-medical coverage is only up to $25,000. Notably, La Capitale only offers permanent simplified and no-medical life insurance, meaning term options are not available for these products.

Since the merger with SSQ under the new name Beneva, those looking to apply for La Capitale life insurance can do so through a quick online process.

What are the pros and cons of La Capitale life insurance?

La Capitale has several pros such as a strong financial background, a wide range of products with various customization options, estate fee coverage, and more. However, there are certain disadvantages in terms of limitations in simplified coverage and no-medical coverage.

Pros of La Capitale life insurance

- Strong financial stability: Backed by the merger with SSQ under the Beneva brand, ensuring long-term reliability

- Comprehensive policy customization: Offers multiple optional riders, including children’s term insurance and critical illness coverage

- Built-in Loss of Autonomy benefit: Included with enhanced products, providing additional financial support in case of loss of independence

- Estate legal fee coverage: Covers up to $1,000 in legal expenses for estate settlement

- Convenient digital access: Provides online account management, e-policy services, and seamless digital access for policyholders

Cons of La Capitale life insurance

- Limited simplified coverage: La Capitale’s coverage is capped at $50,000 for applicants over age 71, which may be insufficient for some needs

- Restricted no-medical coverage: Maximum coverage for no-medical exam policies is limited to $25,000, which may not provide adequate financial protection

What term life insurance amounts and coverage do La Capitale and Beneva offer?

La Capitale offers a variety of term insurance products including the Enhanced Fixed Term, Pure Fixed Term, Enhanced Decreasing Term, as well as a variety of life insurance riders.

Pure Series Term Insurance

- Straight-forward, basic term insurance product designed for income replacement, estate planning, and covering personal and business debts

- Option to exchange the contract term for a longer term during the first 5 years, without evidence of insurability

Coverage and policy details

- Available Term Lengths: 10, 20, 25, 30, or 35 years

- Available Term Types: Level or decreasing

- Maximum Amount of Coverage: $5,000,000

- Renewability: Yes. Renewable as 10-year term to age 85

- Convertibility: Yes. Convertible to up to age 70

Enhanced Series Term Insurance

- Flexible term insurance product designed for income replacement, estate planning, and covering personal and business debts

- Option to exchange the contract term for a longer term during the first 5 years, without evidence of insurability

- Total loss of autonomy benefit built-in

- Succession advantage included (up to $1000 to cover reimbursement of estate fees, Quebec only)

Coverage and policy details

- Available Term Lengths: 10, 20, 25, 30, or 35 years

- Available Term Types: Level or decreasing

- Maximum Amount of Coverage: $5,000,000

- Renewability: Yes. Renewable as 10-year term to age 85

- Convertibility: Yes. Convertible to up to age 70

What other insurance coverage does La Capitale under Beneva offer?

La Capitale offers a variety of customizable insurance products as well as saving and investment products.

Permanent Life Insurance

Permanent life insurance provides you with coverage from the day the policy is settled until the day you die. Premiums are level and guaranteed, and as long as you keep paying the premiums the coverage never expires. SSQ offers three different permanent life insurance policy options: non-participating (Advantage Non-Participating, Pure Term to 100, Enhanced Term to 100) simplified life insurance (Simplified Advantage), and no-medical life insurance (Affirmative).

Simplified Life Insurance

Simplified life insurance coverage has no requirements for a medical exam. To apply, all you need to do is answer some simple questions regarding your health.

The waiting process is shorter and can oftentimes grant you immediate coverage. The tradeoff? Generally, premiums are higher for simplified coverage, and the coverage amount is lower than what you can get with traditionally underwritten life insurance.

La Capitale offers the following simplified life insurance coverage:

- Up to $100,000 in coverage based on age

- Advanced payment up to 50% of coverage if the event results in shortened life expectancy

Critical Illness Insurance

Critical illness insurance is a living benefit insurance policy that pays out a tax-free lump sum if you develop a specified illness, health event (like breast cancer, prostate cancer, skin cancer, heart attack, and coronary angioplasty), or undergo treatment while under its coverage, after a minimum of 30 days from when you are first diagnosed (90 days for cancer).

This coverage is available for a period of time also known as term length, and you determine it when purchasing the policy.

La Capitale, under Beneva, offers critical illness insurance coverage for children and adults with several policy options:

- 25 covered illnesses or surgeries

- Partial payouts for certain conditions

- Renewal up to age 75 and convertible up to age 60

- Available as a separate policy or rider

- Coverage options from $10,000 – $20,000

- Access to Teladoc network (network of doctors and specialists)

Read our full Beneva Critical Illness Insurance Review.

Disability Insurance

Disability insurance, sometimes also referred to as income protection insurance is an insurance product that offers you protection against loss of income by replacing a substantial portion of your paycheque if you become disabled.

La Capitale offers disability illness insurance coverage called the “Pillar Series” income protection plan. It offers:

- Up to $6,000 monthly benefit amount

- Partial benefit options (up to 6 months)

- Coverage on 1st day of hospitalization (90-day elimination period or less)

- Basic coverage for accidents with sickness coverage available as a rider

- Additional simplified accident insurance available (no medical exam required)

Investment and Financial Products

In addition to insurance products La Capitale also offers investment services with over 42 investment accounts available with 5 asset categories: fixed income, balanced, Canadian equity, American and international equity, and portfolios. They also offer RRSP loans and other annuities.

How to access La Capitale insurance policies under Beneva?

To access your La Capitale insurance policy under Beneva, you can use the Beneva Client Centre. If you previously had an online account with La Capitale, your login credentials will remain the same.

Simply visit the Beneva Client Centre and log in to manage your policy, view coverage details, submit claims, and access important documents. If you haven’t registered for an online account yet, you can create one on the same platform by following the registration steps.

You can also use the Beneva mobile app which is available for download on your smartphone. The app allows you to manage your policies, submit claims, and view your insurance documents from anywhere

Does Beneva have an app?

Yes, Beneva has a mobile app that allows policyholders to manage their insurance on the go. The app is available for both iOS and Android devices and provides access to key features such as:

- Viewing insurance policies and coverage details

- Submitting and tracking claims

- Accessing digital insurance documents

- Finding healthcare providers (for health insurance users)

- Contacting customer support

Is Beneva a reliable insurance provider?

Yes, Beneva is considered a reliable insurance provider in Canada. Formed through the merger of La Capitale and SSQ Insurance, Beneva combines decades of experience from both companies, creating one of the largest mutual insurance providers in the country.

Beneva offers a wide range of insurance products, including life, health, auto, home, and business insurance, ensuring comprehensive coverage for individuals and families.

With a strong financial foundation, extensive product offerings, and a customer-focused approach, Beneva has positioned itself as a trustworthy option for insurance seekers.

How do I apply for a term life policy with La Capitale Insurance?

You can apply for La Capitale Life Insurance’s plans by using the best online insurance broker in Canada. You can enter your information and look up quotes using the button below or schedule a call with one of our licensed brokers to apply for La Capitale Life Insurance through Beneva or get an instant quote.

Frequently asked questions

Does La Capitale life insurance cover critical illness?

La Capitale offers an optional critical illness rider under the Beneva name, allowing policyholders to receive a lump-sum payout if diagnosed with a covered critical illness. This rider can be added to eligible life insurance policies for enhanced financial protection.

Will my existing La Capitale life insurance policy be affected by the transition to Beneva?

No, if you had a life insurance policy with La Capitale before the transition, your coverage, benefits, and terms remain unchanged. The only difference is that Beneva now handles policy administration and customer service.

Can I still buy a new La Capitale life insurance policy, or do I need to apply through Beneva?

New life insurance policies are now issued under the Beneva brand, but they still include many of the same coverage options that La Capitale previously offered. Existing policyholders can continue managing their policies as usual.

Has Beneva introduced any changes or improvements to La Capitale’s life insurance products?

While core policy offerings remain similar, Beneva has focused on improving digital services, streamlining customer support, and expanding coverage options to provide a better overall experience for policyholders.

Desjardins Critical Illness Insurance Review – Updated 2025

One of Canada’s largest financial institutions, Desjardins offers comprehensive critical illness coverage for individuals, children, and business owners. In this review, we’ll take a closer look at these offerings — their features, benefits, and downsides — to help you determine if they’re the right fit for your needs.

What are the benefits of Desjardins’ critical illness insurance?

Desjardins’ critical illness insurance, also known as Health Priorities, provides a tax-free lump-sum payment if you’re diagnosed with one of its 26 covered health conditions. This benefit is payable even if you’re diagnosed outside Canada.

Other benefits include:

- Long-Term Care (LTC): In case of loss of independence with a reasonable chance of recovery, Desjardins will pay 15% of your total insurance benefit (up to a maximum of $25,000)