If you’re comparing Sun Life and Manulife for term life insurance, you’re not alone. The moment Canadians start seriously looking at term life coverage, these two names almost always come up first.

On paper, both offer term life coverage. Both provide tax-free payouts to your beneficiaries. Both allow you to choose coverage amounts and term lengths. Both have been around long enough to build serious trust. At first glance, it can feel like you’re choosing between two very similar options.

However, once you look a little closer, the differences start to matter. From plan structure and term flexibility to coverage amounts and optional riders (or even wellness rewards), these details can make one insurer a better fit for you.

Nevertheless, the goal isn’t to declare one universally “better.” Instead, it’s to help you decide which one might be better for you based on your priorities. Let’s start with the quick verdict.

Quick verdict

Choose Sun Life if:

- You are interested in flexible term structures

- You prioritize broader rider options

Choose Manulife if:

- You’re interested in wellness-linked rewards

- You are insuring multiple lives under one policy

Why Sun Life vs. Manulife is a common comparison

When people in Canada start looking for term life insurance, two names consistently pop up online: Sun Life and Manulife, not because of aggressive marketing but because both companies have deep roots in the Canadian insurance landscape and offer broad, accessible term life options.

Term life insurance itself is relatively straightforward. You choose a coverage amount, select a term (such as 10, 20, or 30 years), and if you pass away during that period, your beneficiaries receive a tax-free payout. It’s designed to protect income, cover mortgages, support children, or provide financial stability during your highest responsibility years.

While the concept of term life insurance is simple, the structure of each insurer’s offering is not always identical.

Both Sun Life and Manulife have been operating in Canada for more than a century. Both offer multiple term lengths. Both allow policies to be renewed. Both provide the option to convert certain term plans into permanent life insurance later on.

Due to that overlap, buyers often end up comparing them directly. When two providers offer similar coverage structures alongside strong reputations, the decision shifts from “Is this company reliable?” to “Which one fits my situation better?” That’s where the comparison becomes meaningful.

Instead of vague statements like “both are great,” let’s break down Sun Life and Manulife side by side – looking at the plans’ structure, features, flexibility, and buyer fit, so you can understand not just what they offer, but which one may align better with your priorities.

Sun Life vs. Manulife at a glance

Both Sun Life and Manulife are major players in the Canadian insurance market with long histories and global reach, but there are some meaningful distinctions in size, focus, and operations.

Company snapshot: Sun Life vs. Manulife

| Feature | Sun Life | Manulife |

| Founded | 1865 in Canada | 1887 in Canada |

| Headquarters | Toronto, Ontario | Toronto, Ontario |

| Global presence | Canada, U.S., Asia | Canada, U.S., Asia |

| Core focus | Insurance, wealth and asset management | Insurance, wealth management, and banking services |

| Market position | One of Canada’s largest life insurers | Widely cited as the largest insurance company in Canada by market capitalization and AUMA |

| AM Best Rating | A+ | A+ |

| LICAT Ratio | Well above OSFI’s 100% supervisory target | Well above OSFI’s 100% supervisory target |

| Assets under Management (approx.) | Over CAD 1.3-1.4 trillion | Over CAD 1.4-1.5 trillion |

| Publicly traded | Yes (TSX & NYSE) | Yes (TSX & NYSE) |

About Sun Life term life insurance

Sun Life offers multiple term life insurance plans in Canada designed to support different buying preferences, coverage needs, and underwriting requirements. Out of them, Sun Life Evolve Term is Sun Life’s most customizable term product. It’s built for people who want long-term flexibility.

Sun Life term plans overview

Sun Life Evolve Term is a fully underwritten term life insurance product offering:

- Term lengths from 5 to 40 years

- Higher coverage limits (up to $25 million)

- Option to convert to a longer term length

- Option to increase the coverage amount (but require new underwriting)

- Eligible for conversion to permanent insurance

Besides these, Sun Life also offers Sun Life Go term plans. These plans provide lower maximum coverage than Sun Evolve and may carry higher premiums. For higher coverage amounts, more competitive pricing, flexible term structures, and multi-life planning, Sun Life Evolve may be more suitable.

Also, Sun Life previously offered SunTerm and SunSpectrum Term as its standard life insurance term products, but both were replaced by Evolve Term as a unified, flexible term solution.

Key features of Sun Life term life insurance

Sun Life’s term portfolio is built around flexibility, renewability, and long-term conversion options.

Here are the core features that define most Sun Life term life insurance plans:

- Guaranteed renewability

- Level, guaranteed premiums during the selected term

- Automatically renewable without medical evidence

- Renewable until the policy anniversary nearest age 85

- Ensures continued protection even if health changes over time

- Conversion to permanent insurance

- Eligible term policies can be converted to permanent life insurance

- No additional medical evidence required at conversion

- Conversion deadline is typically before the policy anniversary nearest age 75

- Provides long-term flexibility if insurance needs evolve

- Multiple term length options

- Flexible term lengths: 5 to 40-year terms

- Allows coverage to align with mortgages, income protection timelines, or estate planning strategies

- Flexible coverage structures

- Flexible coverage structures, including: single life, joint first-to-die, multiple life (up to five insureds under one policy)

- This supports both family and business coverage planning

- Optional benefits and riders included

- Child term benefit

- Guaranteed insurability benefit

- Accidental death benefit

- Total disability waiver benefit

- Owner waiver disability benefit

- Business value protection benefit

- Partner protection benefit

- Living benefit access

- May provide up to 50% of the basic insurance amount (maximum $250,000) if diagnosed with a terminal illness

- Offered on a discretionary, compassionate basis

Pros and cons of Sun Life term life insurance

| Pros | Cons |

| Renewable without medical evidence to age 85 | Renewal premiums increase after the initial term ends |

| Convertible to permanent insurance without medical evidence before age 75 | Living Benefit is discretionary, not contractually guaranteed |

| Multiple term lengths available (5 to 40 years, depending on product) | Monthly premium payments cost slightly more than annual payments |

| Term exchange option (10/15 to 20/30 within five years) | |

| Multi-life and joint first-to-die options (up to five insureds) | |

| Wide range of optional riders, including business-focused benefits |

About Manulife term life insurance

Manulife term life insurance provides affordable financial protection for you and your loved ones in case of death during a specified period. The company offers several term life options intended to fit different needs, ranging from simple, easy-to-apply plans to more flexible plans with higher coverage limits and optional wellness-linked features.

Manulife term plans overview

- Manulife Family Term

- Designed for family or business protection

- Available as single life or multi-life coverage

- Lower premiums if you protect two or more people under a single policy

- Pay level premiums for 10 years, 20 years, to age 65, or for life

- Broad coverage range ($100,000 to $20 million)

- Optional riders, such as disability waiver

- Includes a terminal illness benefit

- 30-day money-back guarantee

- Family Term with Vitality Plus

- Includes access to the maximum benefits of the Manulife Vitality program

- Potential rewards or premium benefits based on healthy lifestyle engagement

- Track physical activity and health goals through the Vitality platform

- Incentives may include gift cards, device discounts, etc

- Pay level premiums for 10 years, 20 years, to age 65, or for life

- Broad coverage ($250,000 to $25 million)

- Same term options: T10, T20, T65, and T100

- Includes coverage for bereavement counselling costs up to $1,000

- Includes a terminal illness benefit

Besides these, Manulife also offers CoverMe term life plans, including Term 10, Term 20, and Easy Issue options. These plans are designed for simplified online purchase but come at significantly higher prices. For higher coverage amounts, affordable premiums, flexible term structures, and multi-life planning, Manulife Family Term is a more comprehensive offering.

Key features of Manulife term life insurance

Across its term life products, Manulife’s term portfolio focuses on guaranteed premiums, renewability, and optional wellness-linked features.

- Level, guaranteed premiums

- Premiums remain level during the selected term

- Provides cost predictability during the chosen coverage period

- Multiple-term options

- Term 10 (T10)

- Term 20 (T20)

- Term 65 (coverage to age 65)

- Term 100 (lifetime coverage)

- Convertibility

- Transition from temporary term coverage to permanent coverage

- Conversion typically does not require new medical evidence

- Helps preserve insurability if long-term needs evolve

- Multi-life flexibility

- Ability to cover multiple individuals under a single policy

- Multi‑life structures can be cost‑efficient (e.g., shared policy fees), but savings vary by case

- Suitable for family income protection or business partner planning

- Manulife Vitality integration

- Wellness-linked rewards program

- Potential rewards or benefits tied to healthy activities

- Includes bereavement counselling coverage up to $1,000 with Vitality Plus benefits

- 30-day money-back guarantee

- Cancel your policy within 30 days of receiving it (varies by product)

- If you cancel within that period, Manulife refunds the premiums paid

Pros and cons of Manulife term life

| Pros | Cons |

| Level, guaranteed premiums during the selected term | Terminal illness advance is subject to policy conditions |

| 30-day money-back guarantee | Easy Issue coverage amounts limited to $50,000 or $75,000 only |

| Terminal illness benefit available on most plans up to 50% capped, e.g., $250k) for current Family Term | Higher coverage plans require full underwriting |

| Simplified issue option with no medical exam (Easy Issue) | Vitality benefits are only available on select plans |

| High coverage limits available (up to $20 million on Family Term options) | |

| Manulife Vitality rewards program available |

Sun Life vs. Manulife comparison

| Feature | Sun Life term life insurance | Manulife term life insurance |

| Number of term products | Multiple term plans | Multiple term variants |

| Term length flexibility | Flexible term length to choose from; 5 to 40 years available | Structured term tiers only; T10, T20, T65, and T100 |

| Term exchange option | 10/15-year terms can be exchanged for 20/30 years within 5 years (no medical evidence) | Option to exchange Term 10 to Term 20 or to Term 65 |

| Renewability | Renewable without medical evidence to age 85 | T10/T20 renewable to age 85; T100 is lifetime level-premium and not renewable |

| Convertibility | Convertible to permanent insurance before age 75 | Convertible on select plans only |

| Multi-life coverage | Single, joint first-to-die, or up to 5 insureds under one policy | Available on Family Term options |

| Maximum coverage limit | Up to $25 million (for evolve term) | Up to $20 million (for family term) |

| Simplified/no medical option | Sun Life Go Simplified available | CoverMe Easy Issue available |

| Wellness rewards program | Not included | Available only on Family Term with Vitality Plus |

| Additional riders available | Multiple optional benefits: Child term, guaranteed insurability, disability waiver (insured & owner), renewal protection (T10), business value & partner protection riders | Fewer riders available; availability varies by plan (e.g., disability waiver on Family Term) |

Our Ratings

Who should choose Sun Life?

Sun Life may be a better fit for buyers who value flexibility and rider customization within their term policy. Its plan is designed for people who want more control over how their coverage evolves. It suits buyers who think beyond just price and focus on long-term insurability and planning. Choose Sun Life if:

- You want precise term alignment. If you’re trying to match coverage exactly to a mortgage, loan schedule, or business obligation, Sun Life’s flexible term lengths (including 5, 15, or up to 40-year options through Evolve) may allow more precise planning.

- You want the ability to exchange terms early. If you’re unsure whether 10 or 15 years will be enough, Sun Life’s term exchange feature (10/15 to 20/30 within the first five years without medical evidence) can provide flexibility if your needs change early in the policy.

- You anticipate evolving business needs. Sun Life offers business-focused riders such as partner protection and business value protection. If you are a business owner, this added customization may be important.

- You prefer wider rider options. If optional benefits like child term riders, guaranteed insurability, disability waivers, or accidental death coverage are priorities, Sun Life provides broader rider selection across its advisor-based plans.

Who should choose Manulife?

Manulife Family Term may appeal to buyers who want more than just basic term coverage, particularly those who value lifestyle-linked engagement, structured retirement planning, and the option of lifetime coverage. Choose Manulife if:

- You’re interested in wellness-linked rewards. Family Term with Vitality Plus integrates the Manulife Vitality program, which encourages healthy behaviour through activity tracking and reward incentives. For buyers who like the idea of engaging with their policy, this can be a meaningful differentiator.

- You want coverage aligned to your working years. Term 65 (T65) provides protection up to age 65, aligning coverage directly with income-earning years. This can simplify retirement planning without requiring policy renewal beyond that age.

- You prefer lifetime level-premium coverage from the start. Term 100 (T100) offers lifetime protection with level premiums and no renewal requirement.

- You are insuring multiple individuals under one contract. Family Term allows multi-life coverage and may offer efficiencies when protecting two or more insured individuals under a single policy. It also comes with additional support features, such as bereavement counselling.

Final Verdict: Sun Life or Manulife

Best overall: Sun Life

Sun Life earns a slight overall edge due to slightly flexible term options and broader rider selection. For buyers focused on long-term planning depth rather than just short-term coverage, Sun Life might be better.

Best for price: Tie

It depends on the underwriting profile. Both Sun Life and Manulife offer competitive pricing depending on age, health, coverage amount, term length, etc. Actual pricing will vary by individual risk profile. Comparing quotes side by side can be helpful.

Want to see how your personal pricing compares between Sun Life and Manulife? PolicyAdvisor can generate personalized term life quotes so you can choose confidently.

Best for flexibility: Sun Life

Sun Life takes the lead here. It offers various flexible term lengths from 5 to 40 years to choose from, term exchange options (10/15 to 20/30), multi-life structuring (up to five insureds), broader rider customization, and more.

Best for high coverage needs: Sun Life

Sun Life (slight edge). Both insurers support high coverage amounts. However, Sun Life advisor products support coverage up to $25 million, while Manulife Family Term supports coverage up to $20 million.

Best for wellness-linked benefits: Manulife

Manulife is better. The Family Term with Vitality Plus plan includes a wellness rewards program and a bereavement counselling benefit (up to $1,000). This adds a lifestyle engagement component that Sun Life’s term products do not include.

Best for structured business planning: Sun Life

Sun Life’s term products include business-focused riders such as partner protection and business value benefits, along with multi-life structuring. This may suit business owners seeking a more tailored protection design.

Frequently asked questions

Which insurer offers higher term life coverage limits: Sun Life or Manulife?

Sun Life typically offers coverage amounts up to $25 million, while Manulife Family Term provides up to $20 million. For high-net-worth or business protection planning, that additional ceiling may be relevant.

Does Sun Life or Manulife offer better flexibility?

Both Sun Life and Manulife offer flexible term plans. Sun Life offers 5, 15, and up to 40-year terms, whereas Manulife also includes age 65 (T65) and lifetime coverage (T100).

Can I convert my term life policy to permanent insurance?

Both Sun Life and Manulife Family Term policies may be convertible to eligible permanent life insurance products, subject to policy terms and deadlines.

Which insurer is better for business owners?

Sun Life may have an edge for business-focused planning due to riders such as partner protection and business value protection. Both insurers offer multi-life configurations, but Sun Life provides broader rider options tailored for structured business arrangements.

Does Manulife offer wellness rewards on term life insurance?

Yes. Manulife Family Term with Vitality Plus integrates the Manulife Vitality program, which provides activity-based rewards and includes bereavement counselling coverage. Sun Life term products do not include a wellness-linked rewards program.

Which term life insurance is cheaper: Sun Life or Manulife?

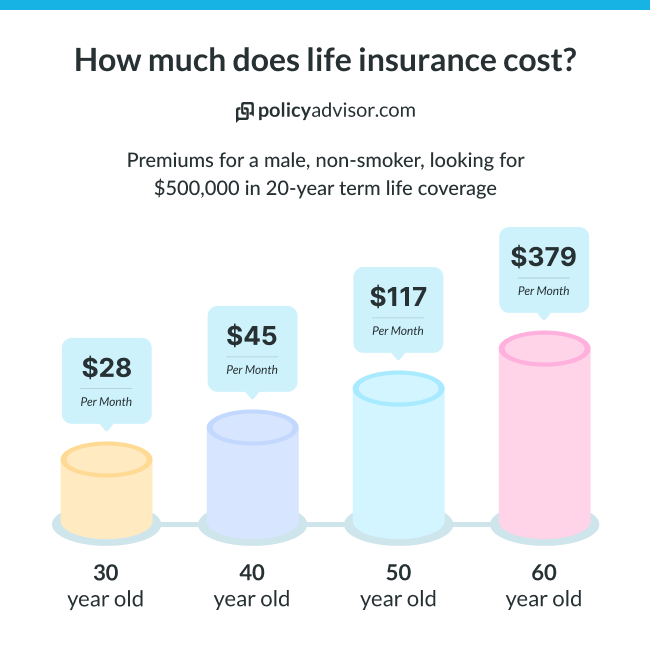

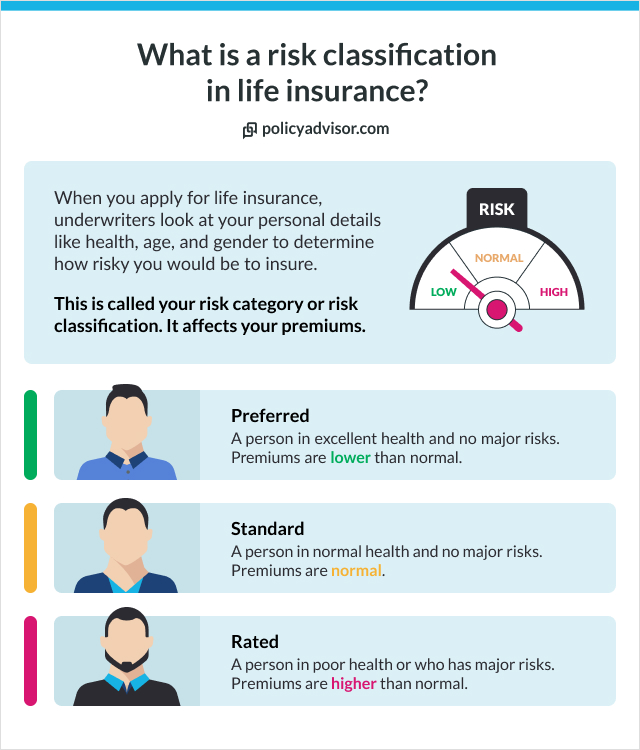

Pricing depends on your age, health classification, smoking status, and coverage amount. Both insurers offer competitive underwriting tiers. The best way to determine pricing is to compare personalized quotes side by side based on your profile.

Can I insure multiple people under one policy?

Yes. Both Sun Life and Manulife Family Term allow multi-life coverage structures. Sun Life supports up to five insured lives under one contract, while Manulife Family Term also supports multi-life configurations.

Is lifetime term coverage available?

Manulife offers Term 100 (T100), which provides lifetime level-premium coverage without renewal. Sun Life does not offer a direct “Term 100” equivalent, but eligible term policies can be converted to permanent insurance before age 75.